PayPal financial services

Role: visual Design Lead | sr UX Designer

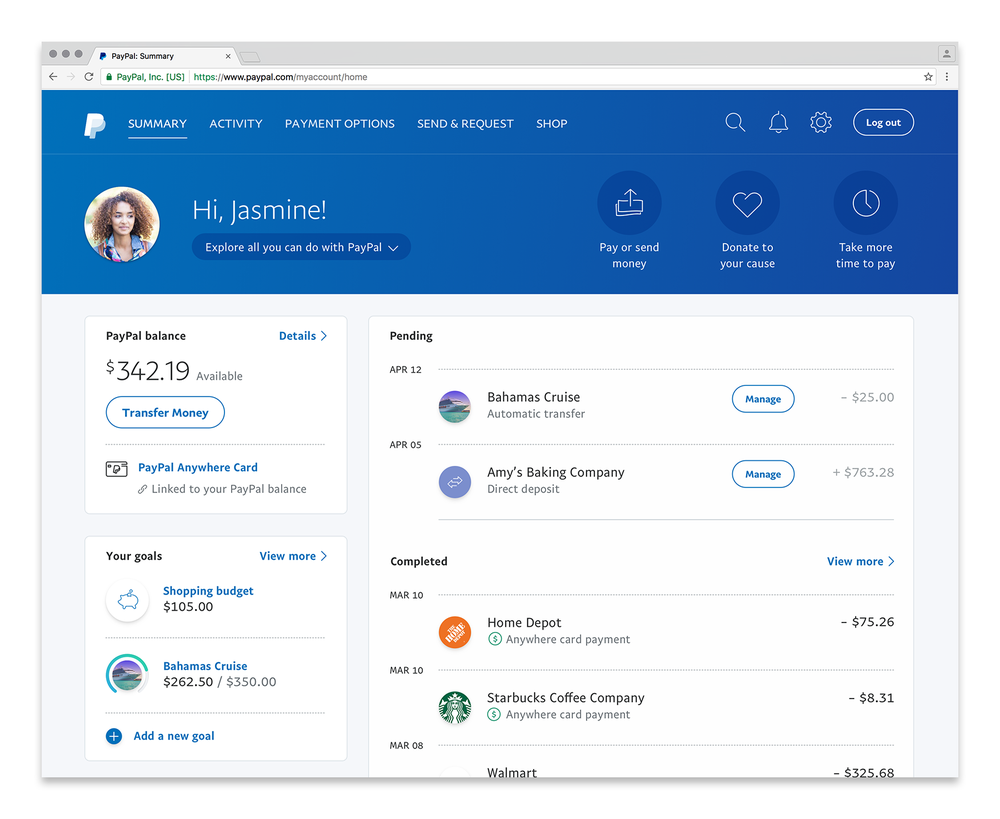

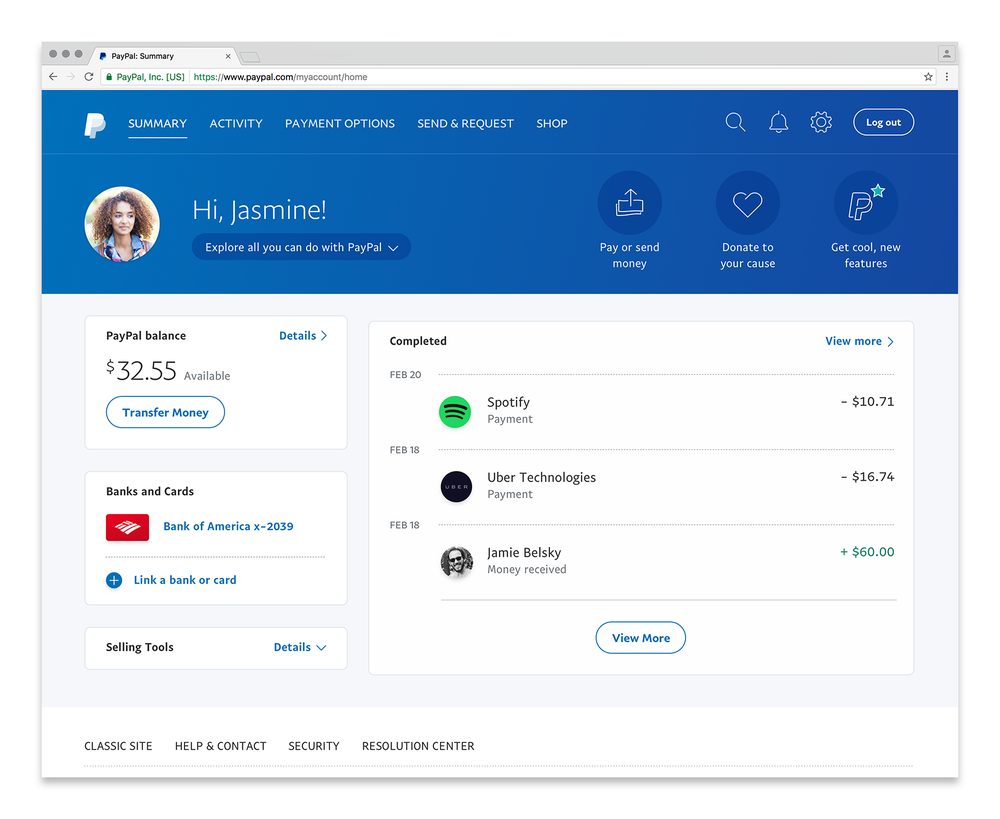

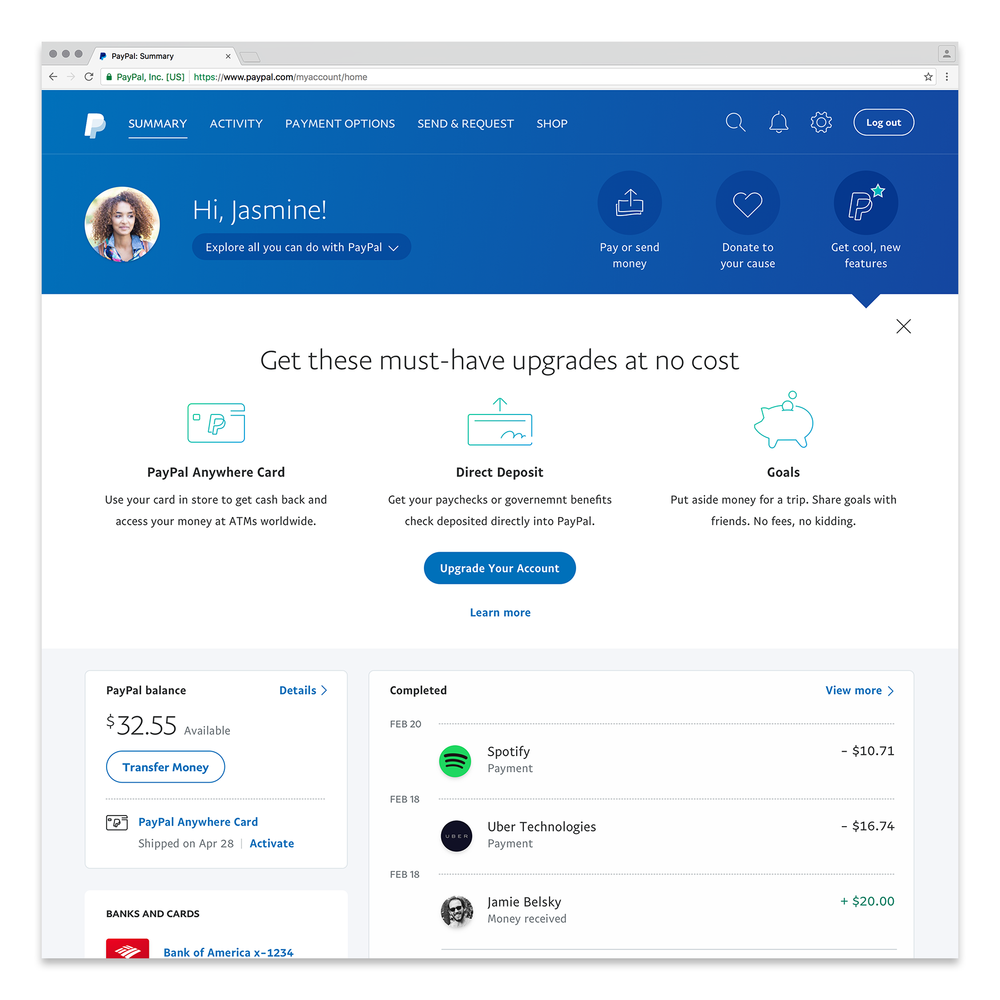

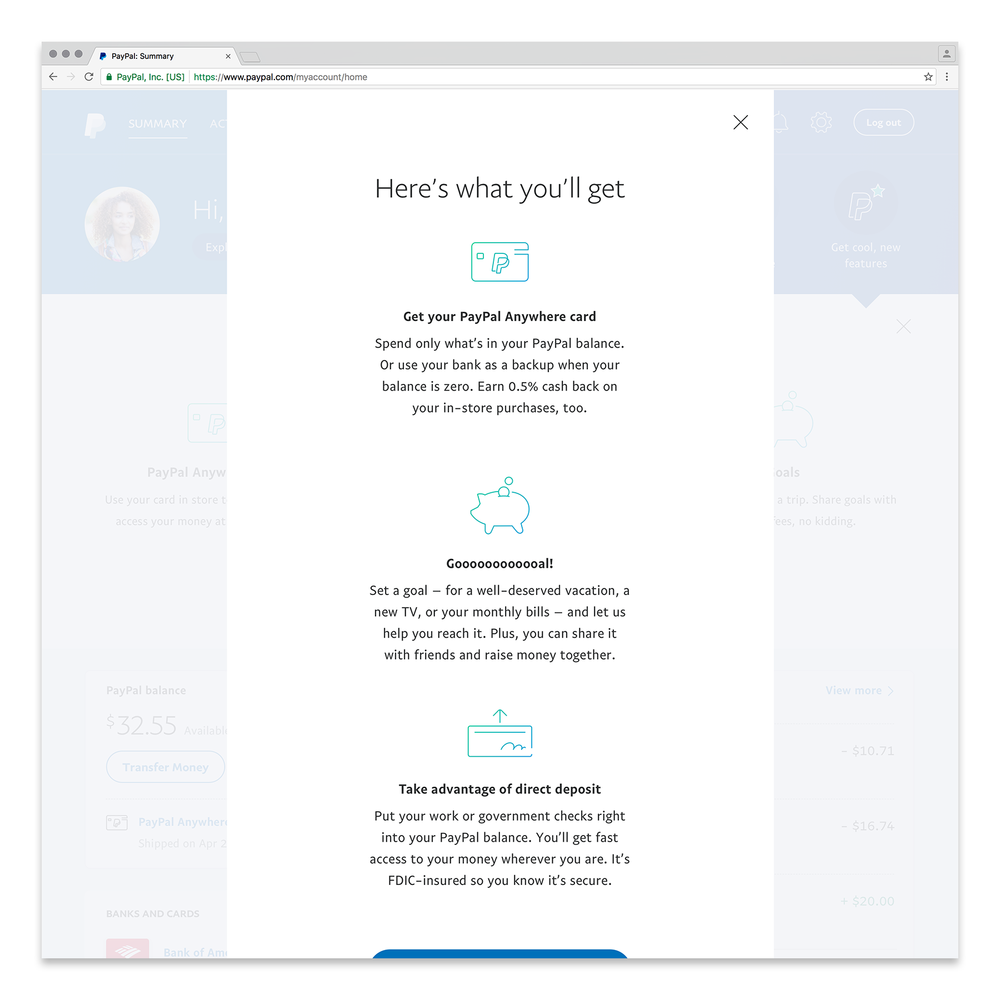

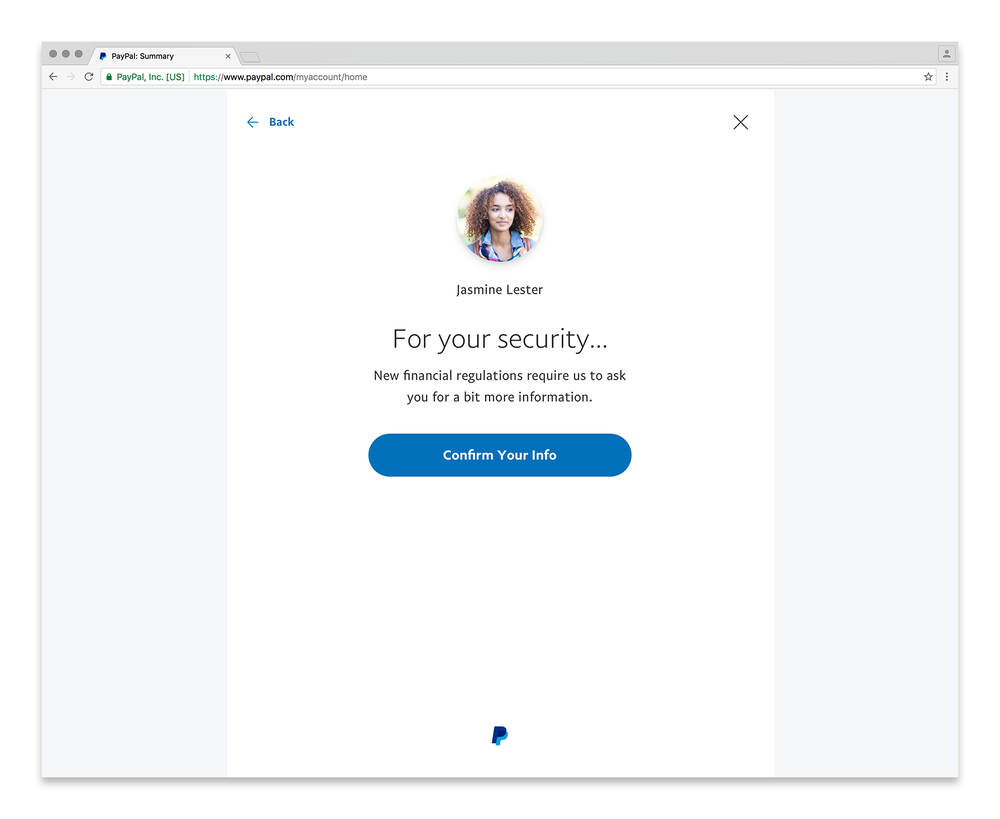

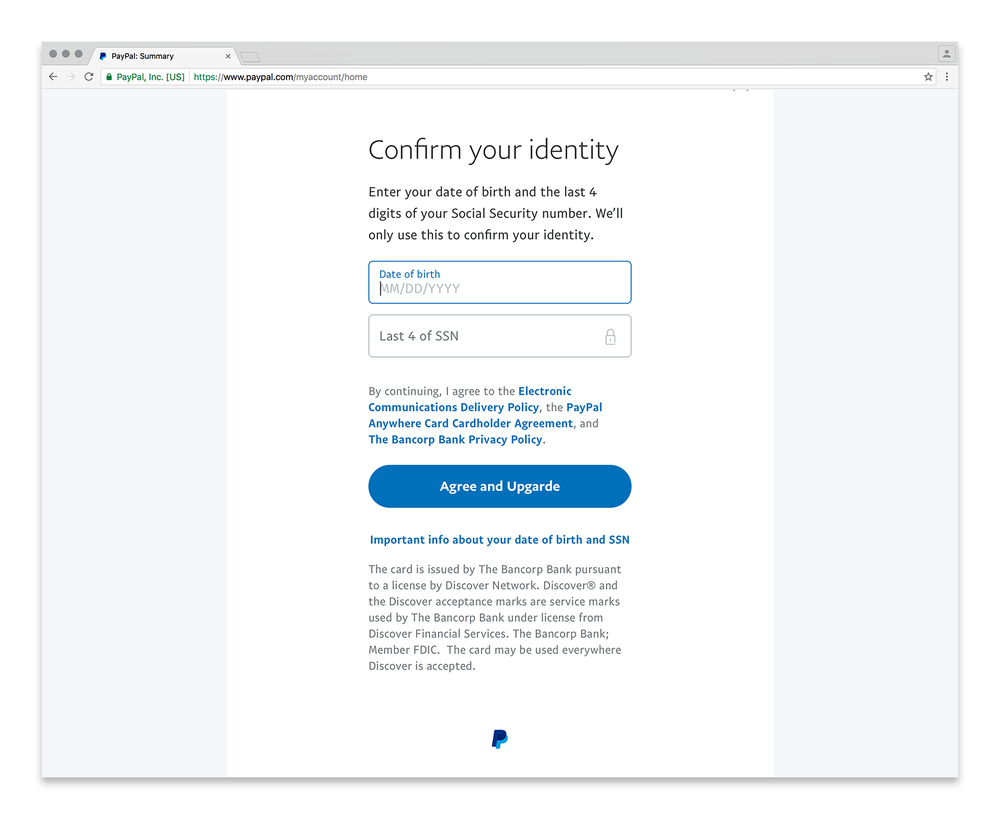

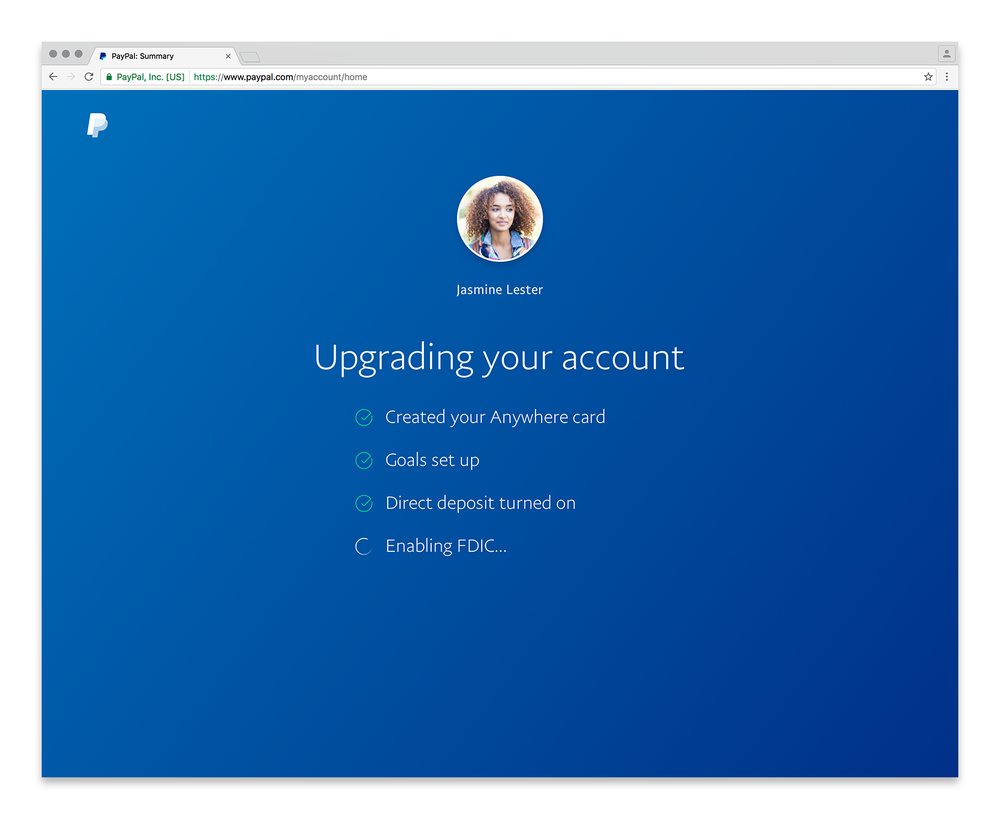

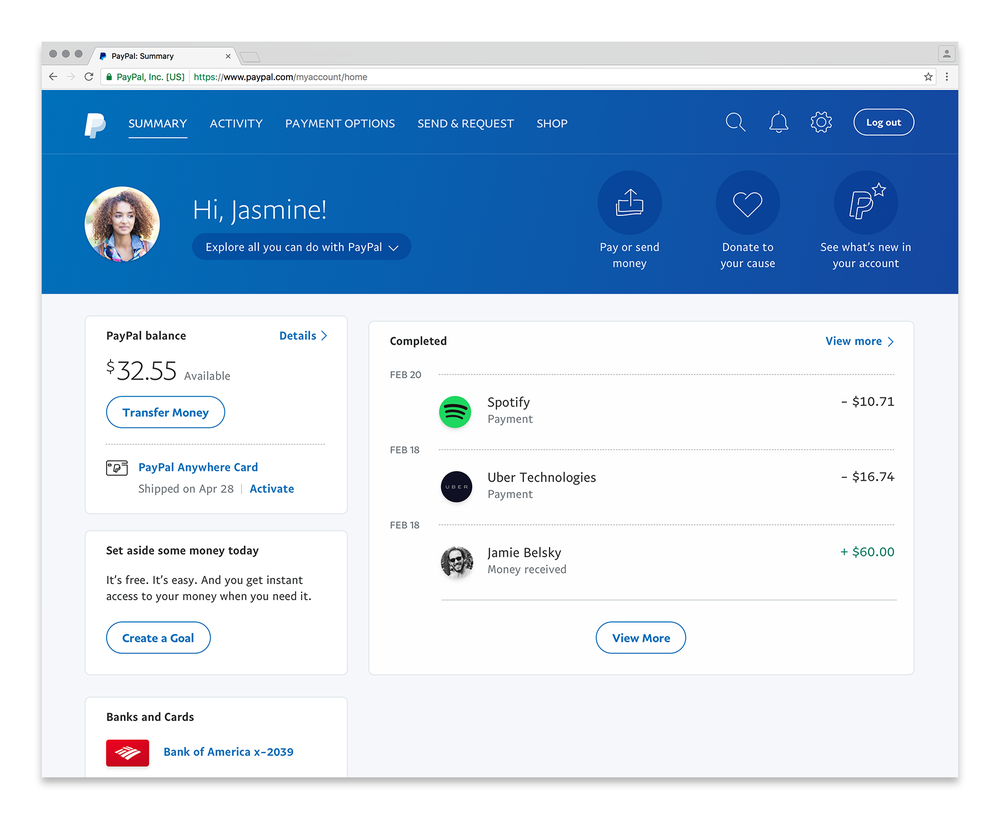

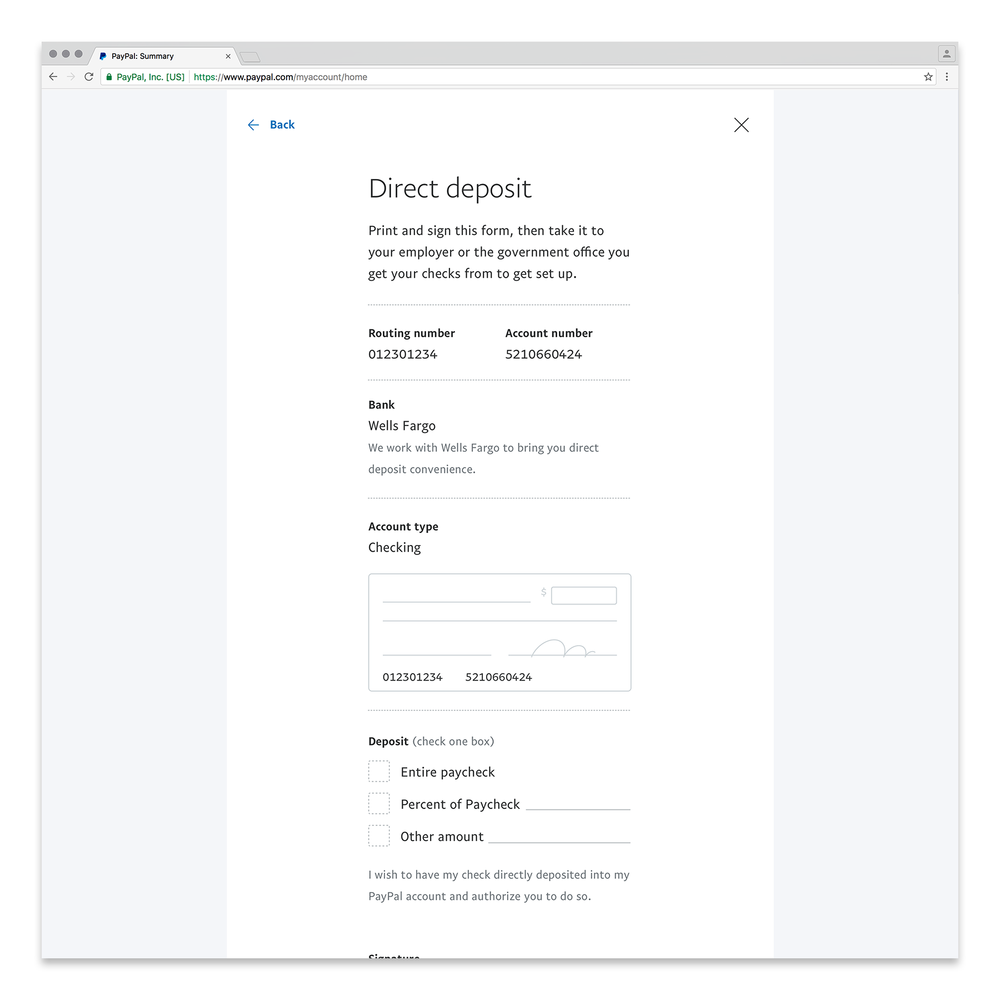

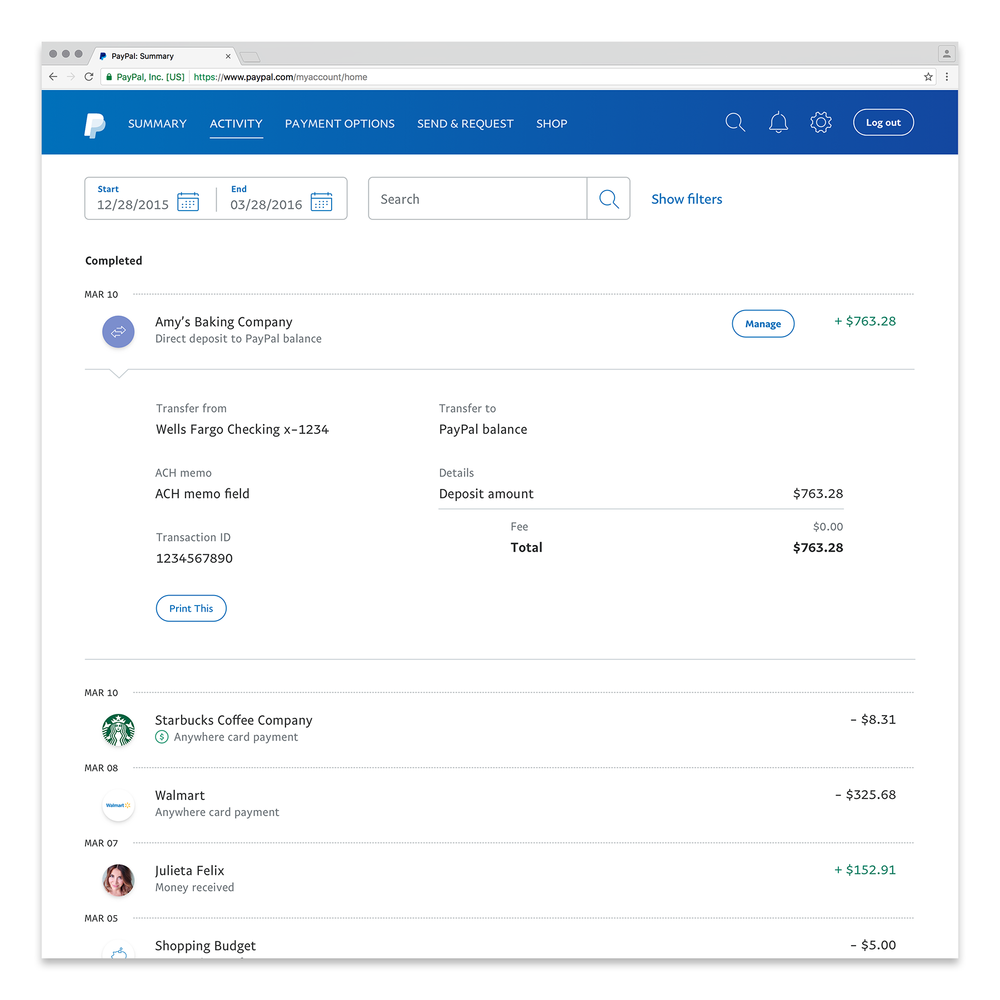

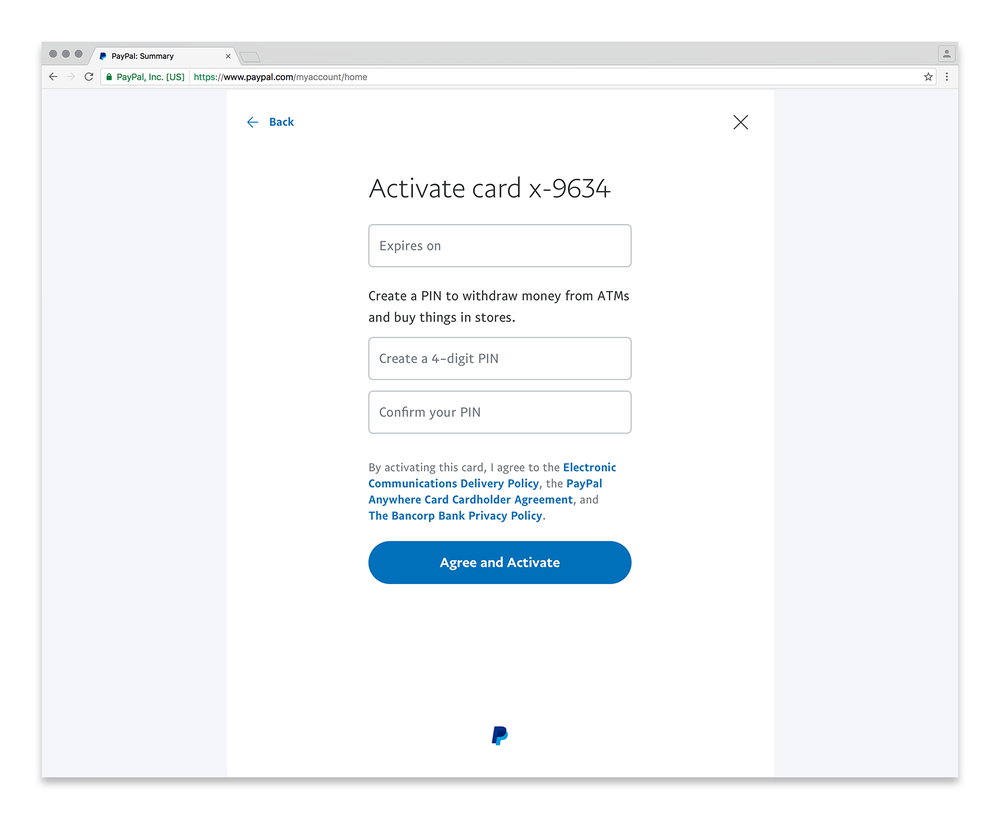

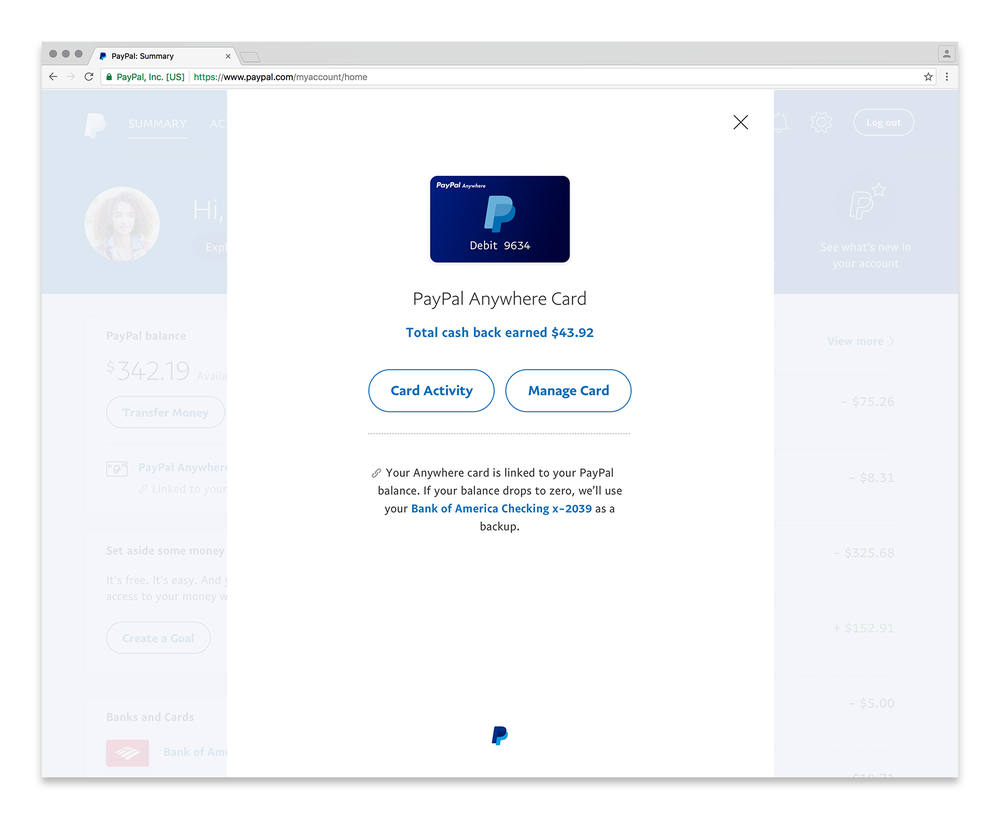

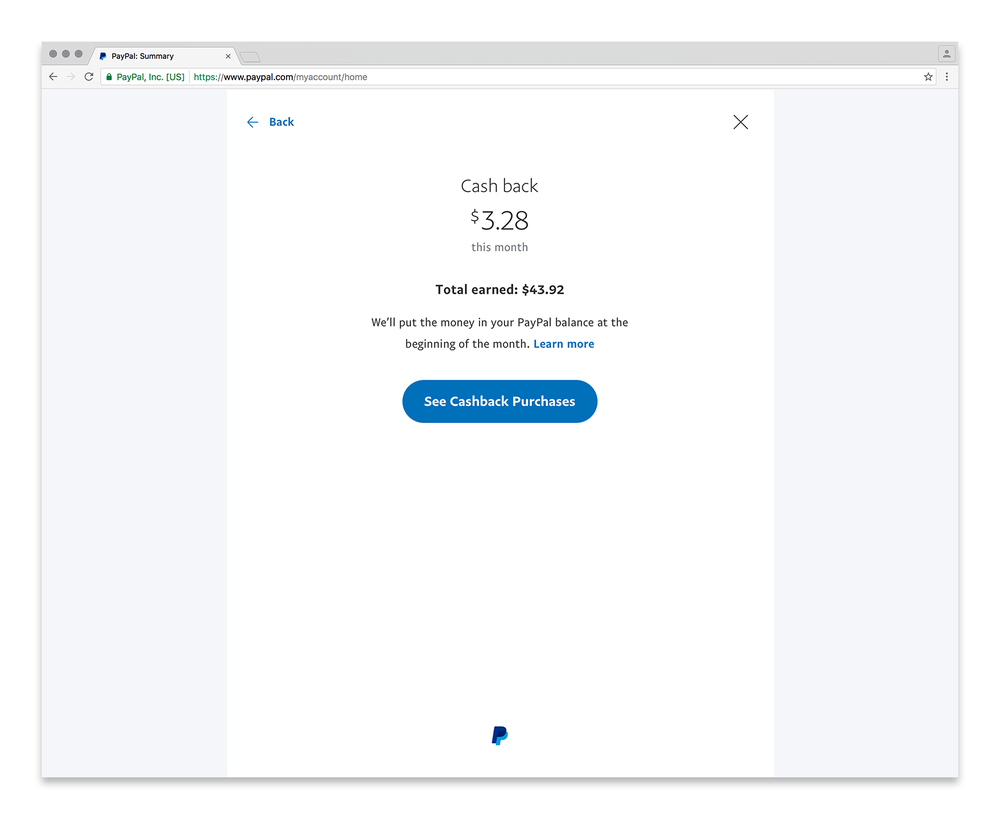

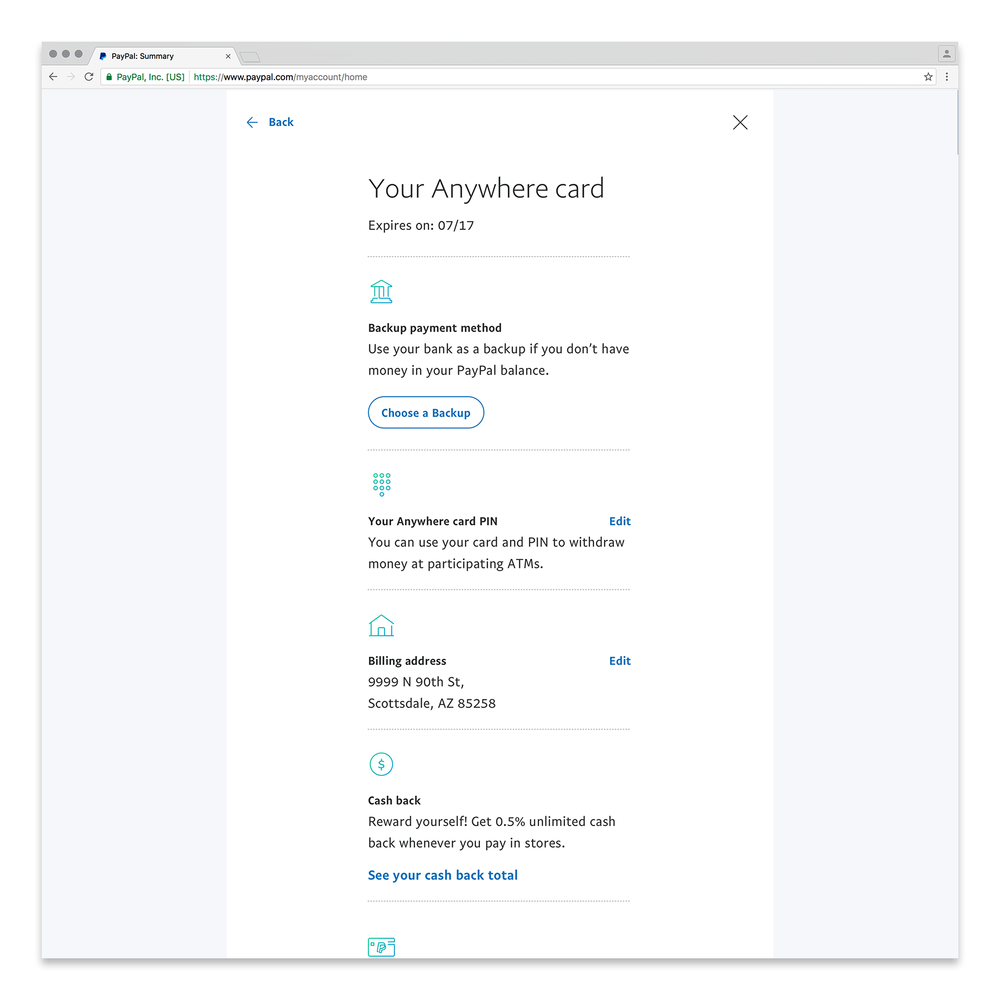

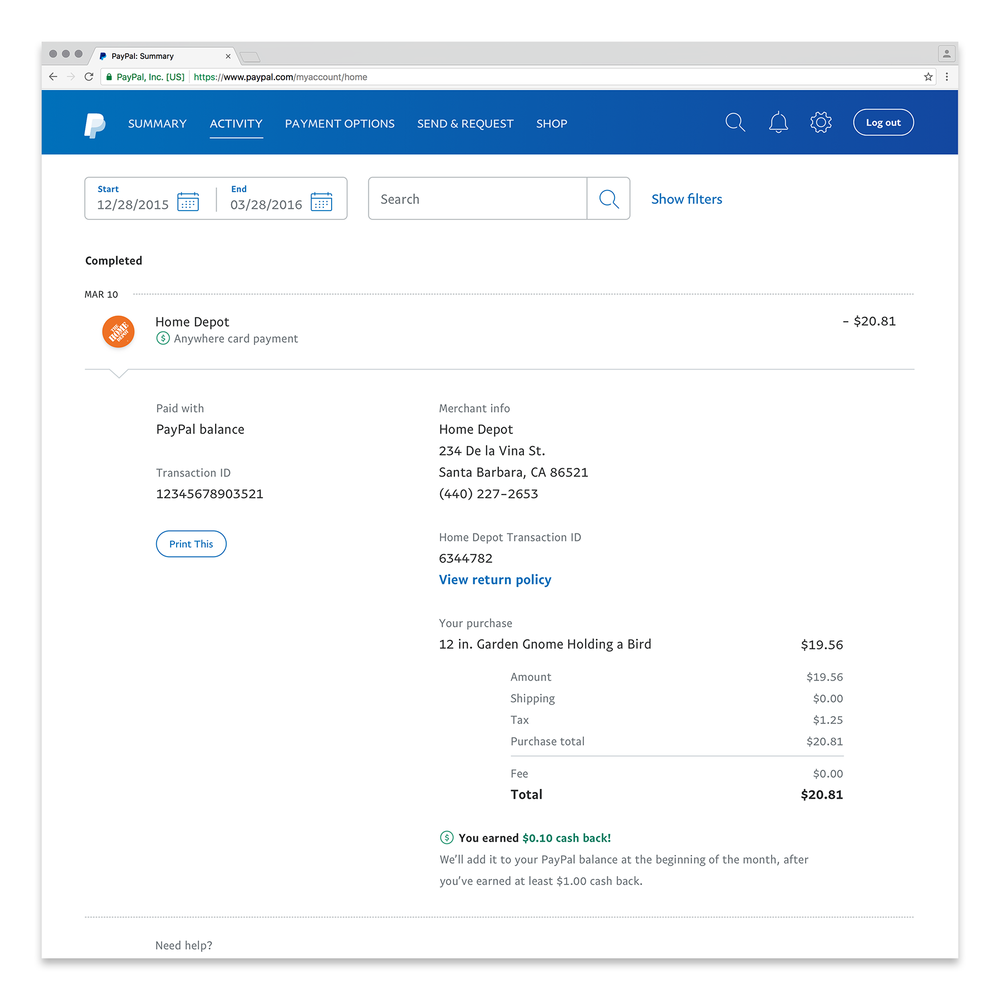

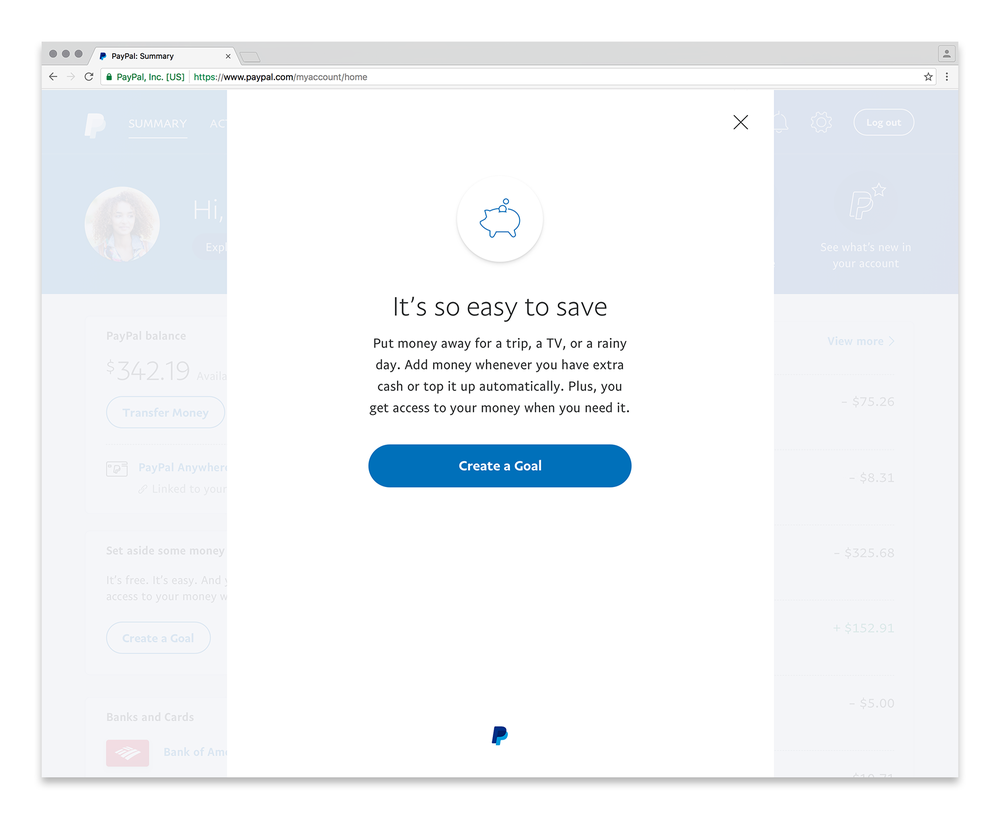

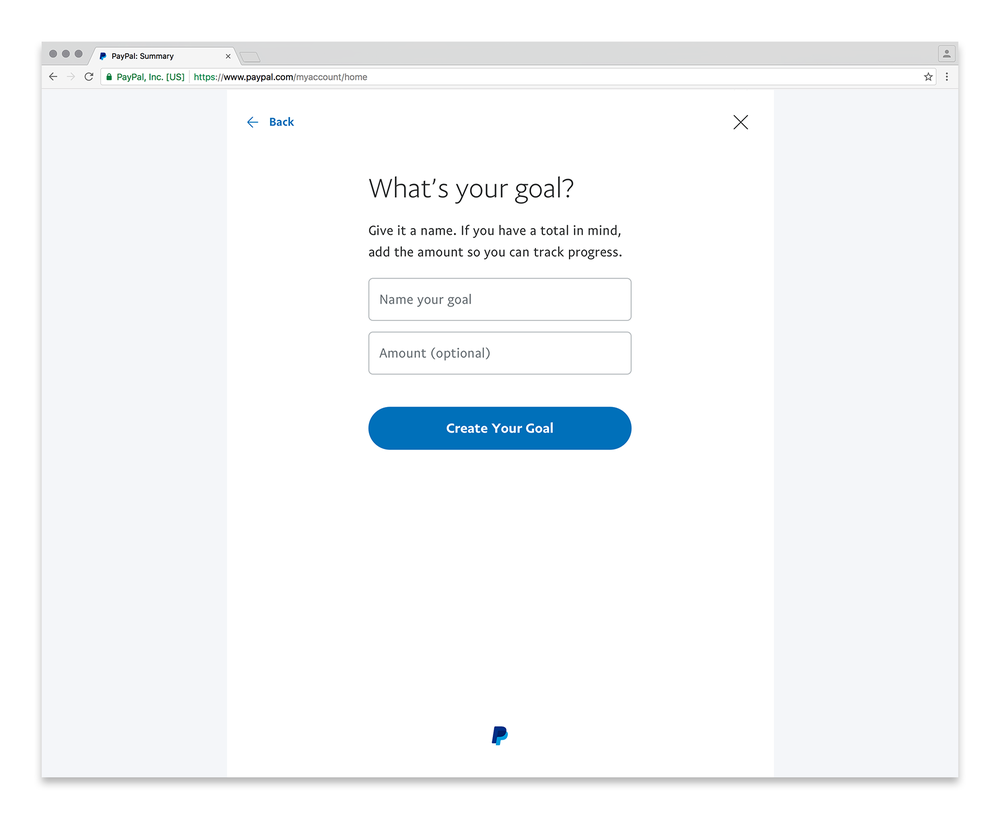

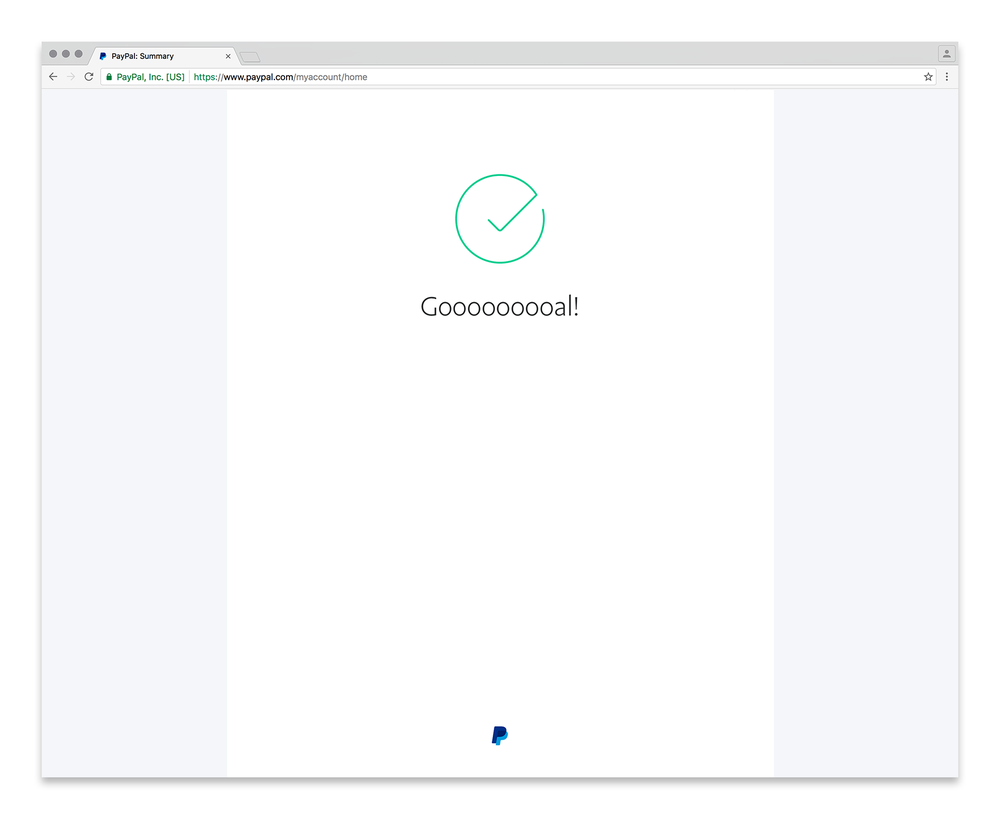

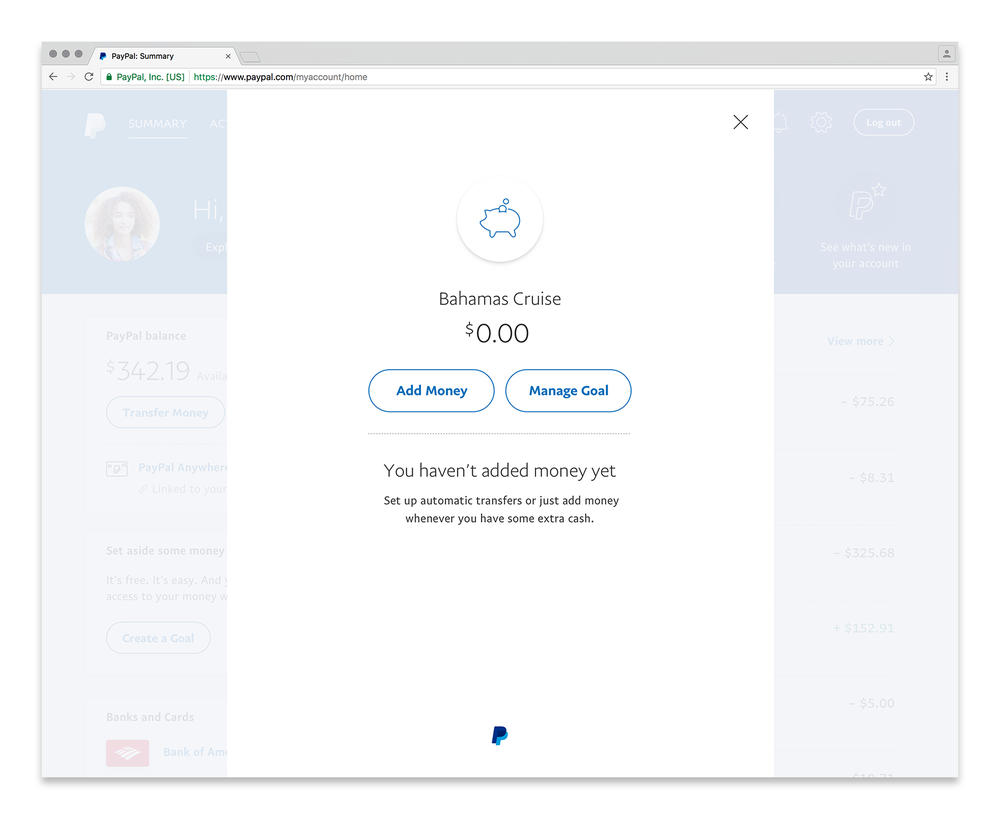

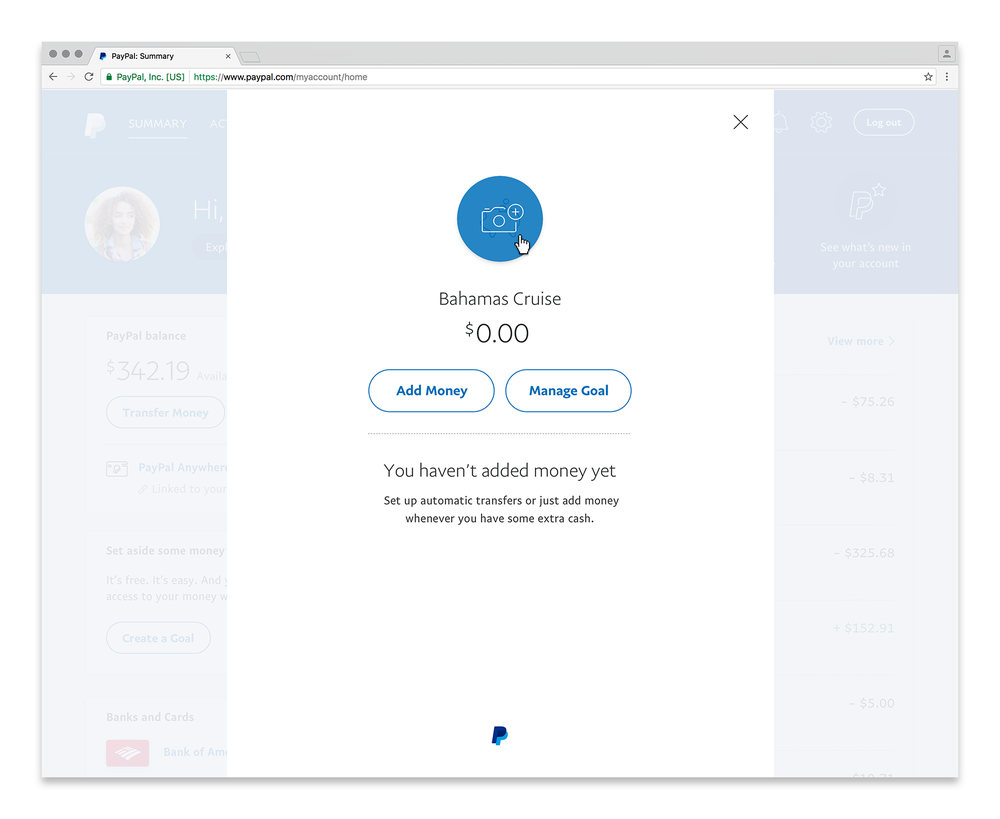

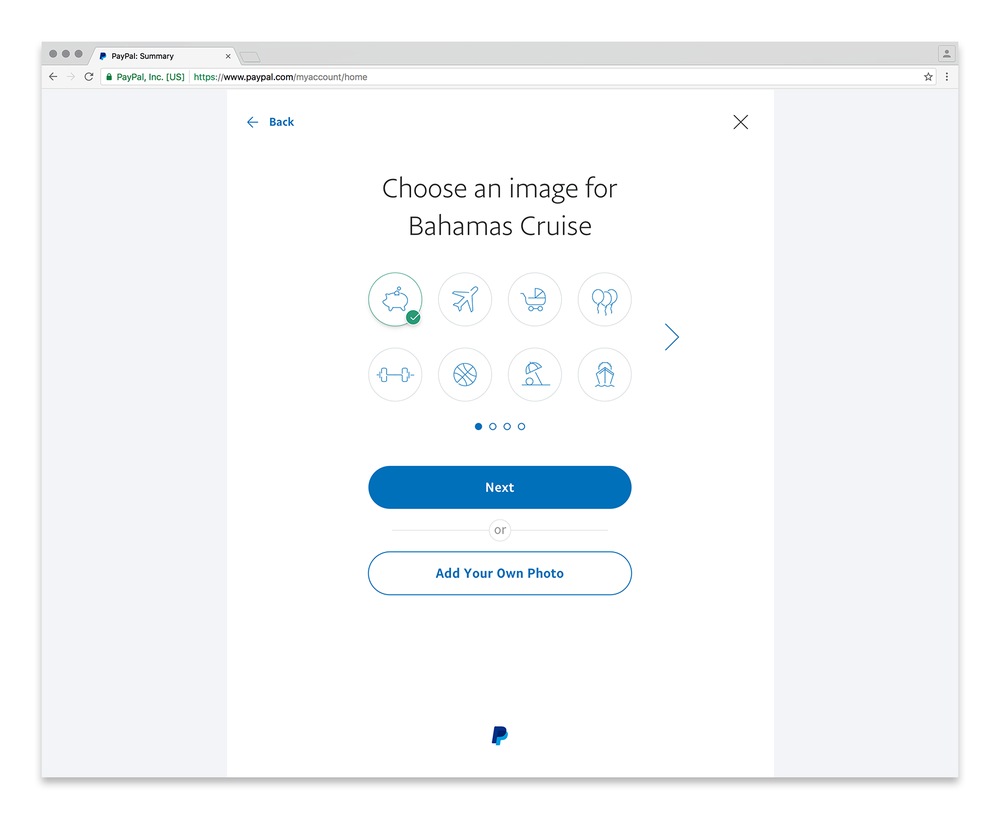

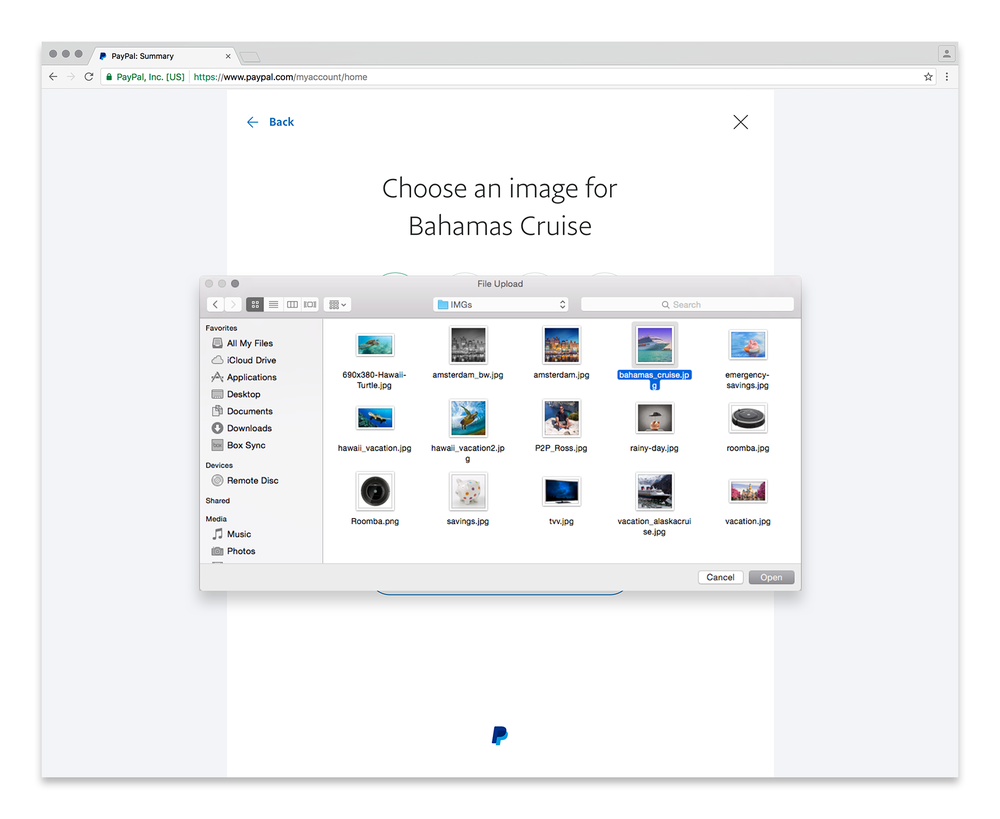

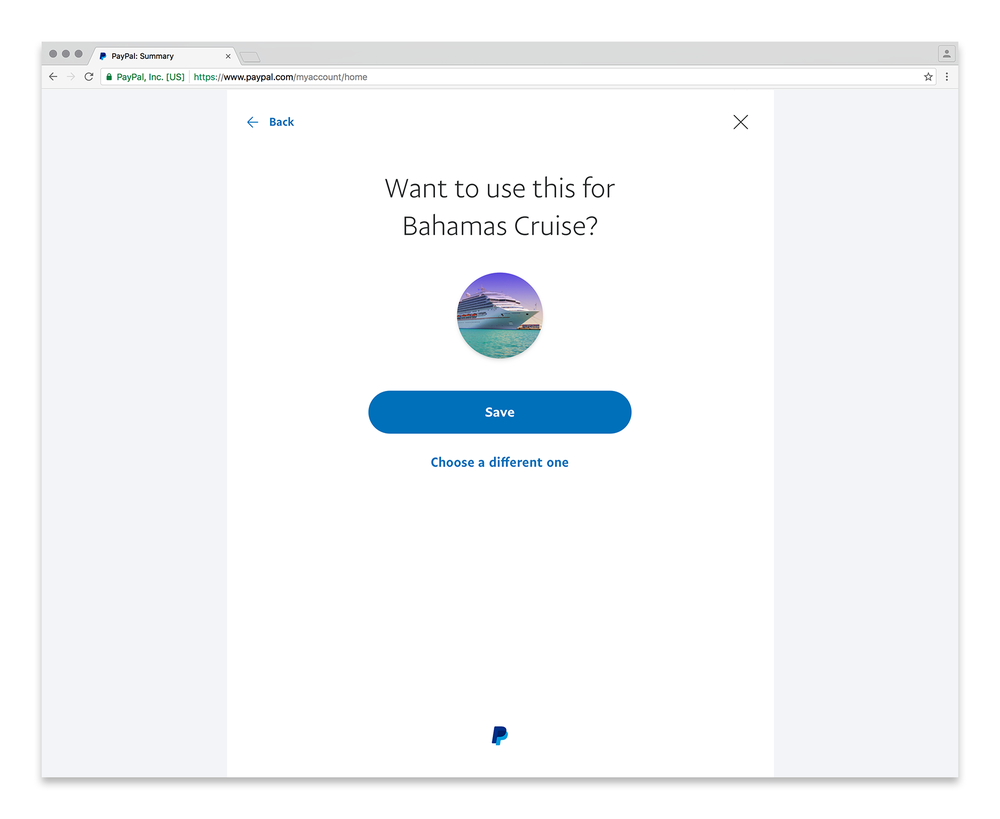

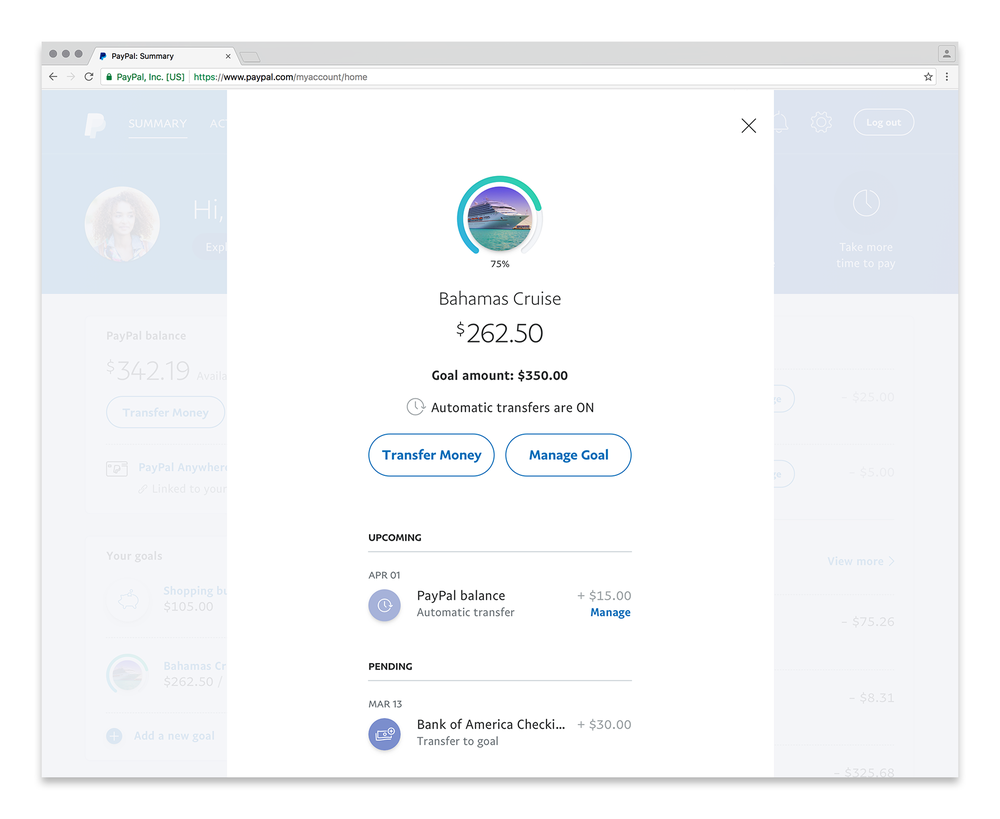

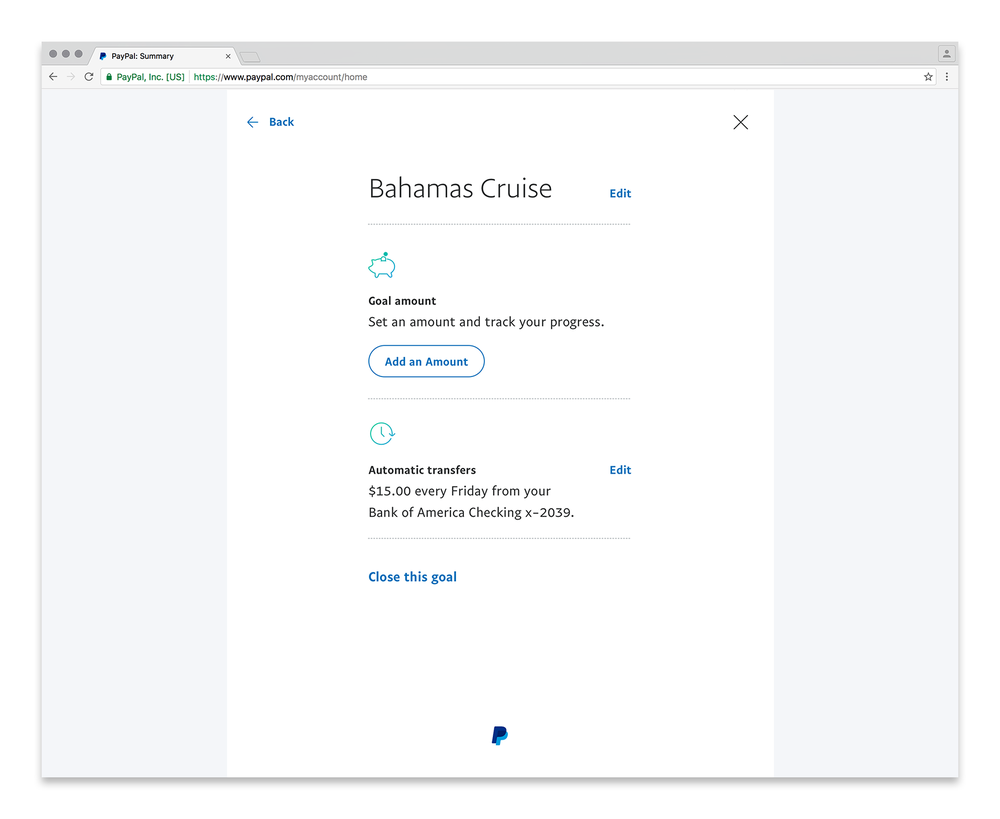

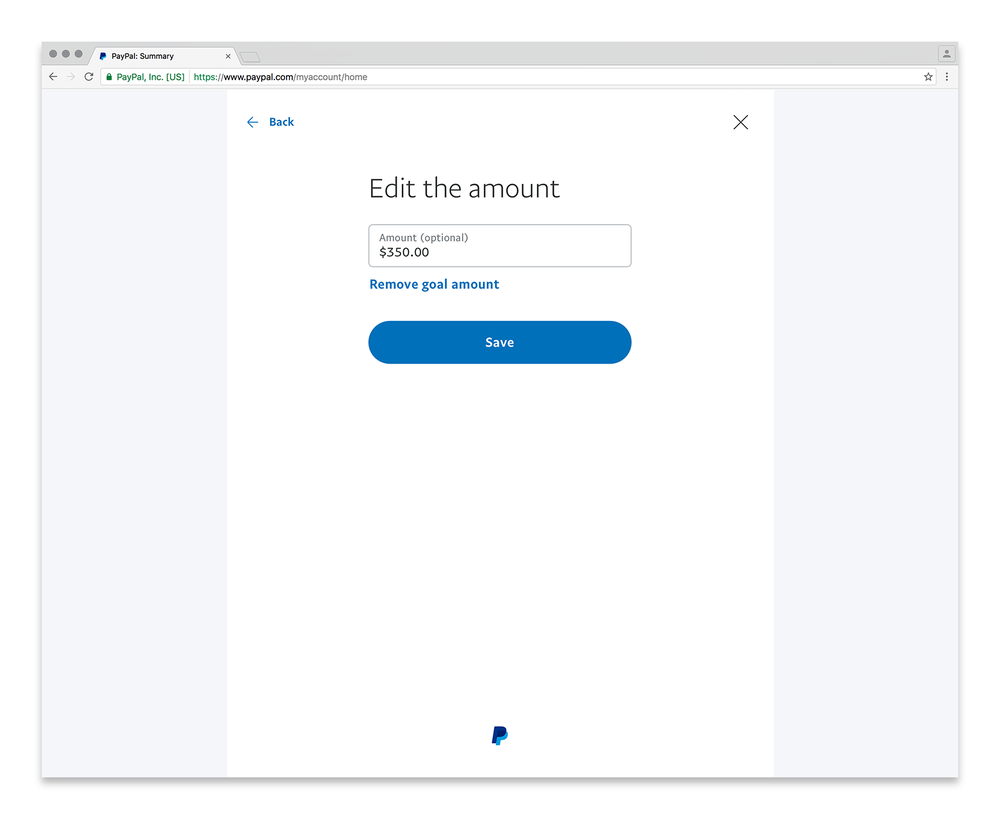

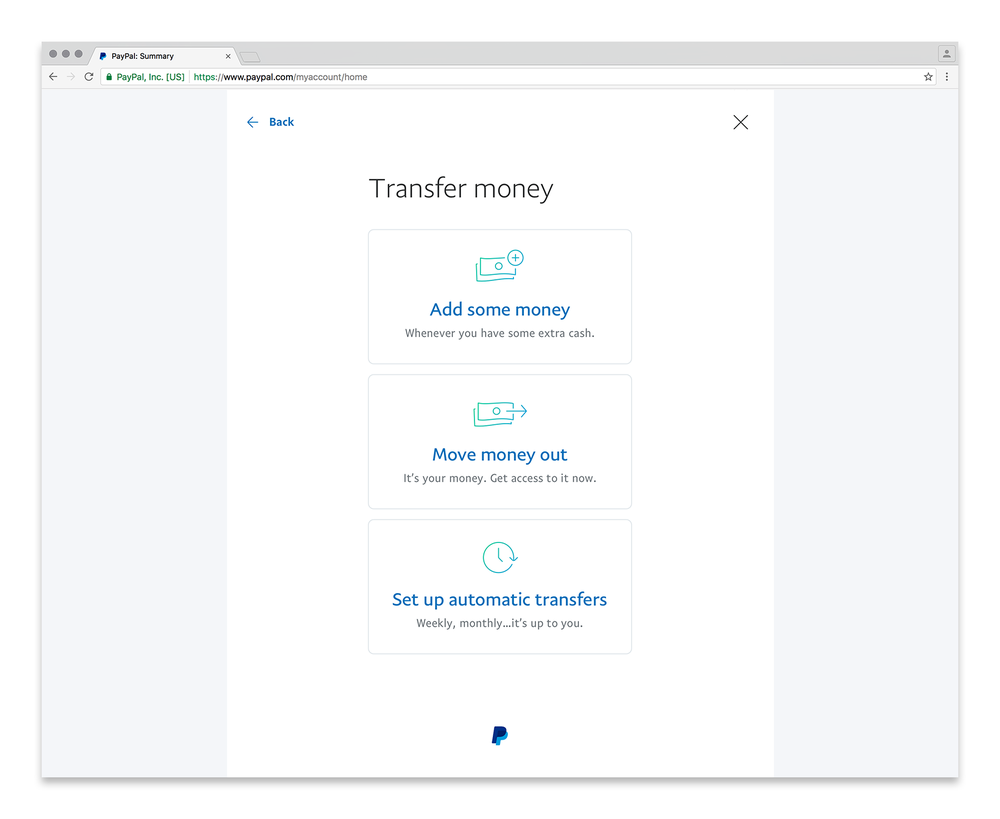

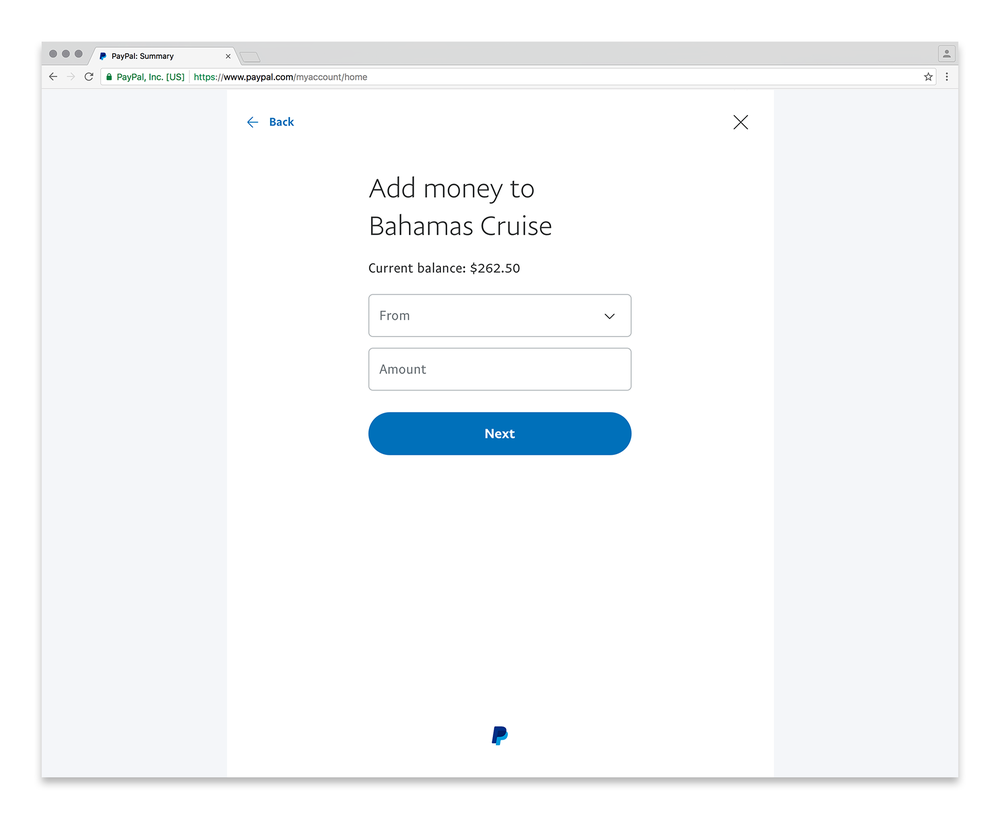

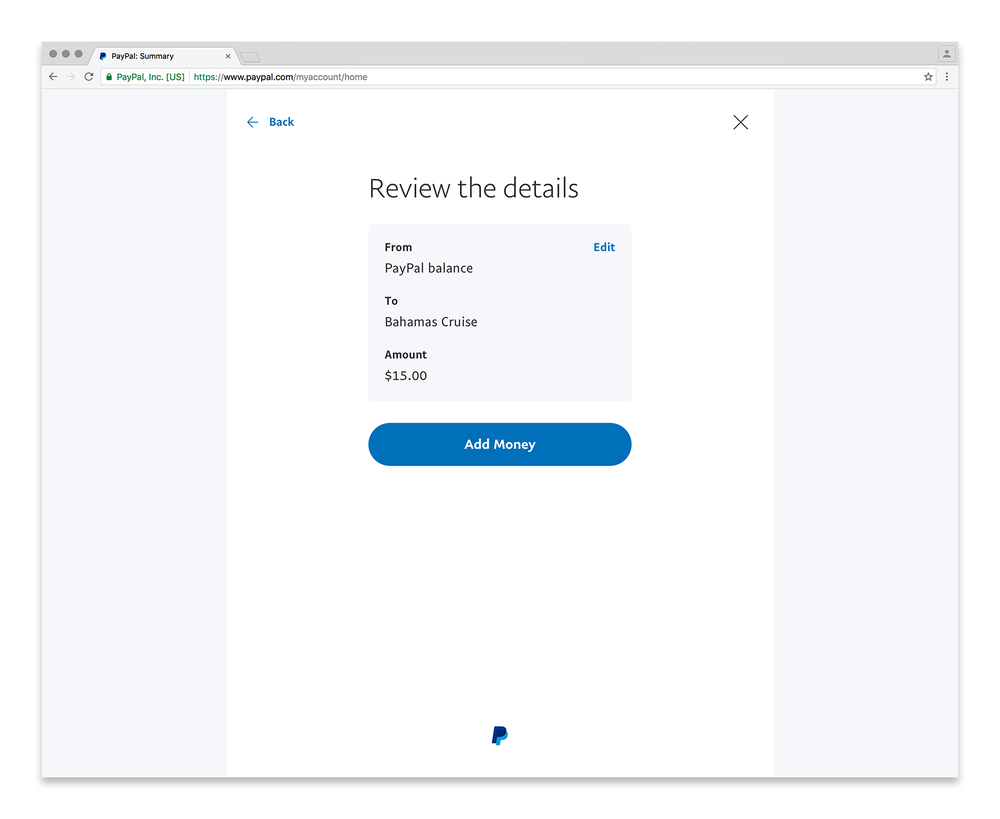

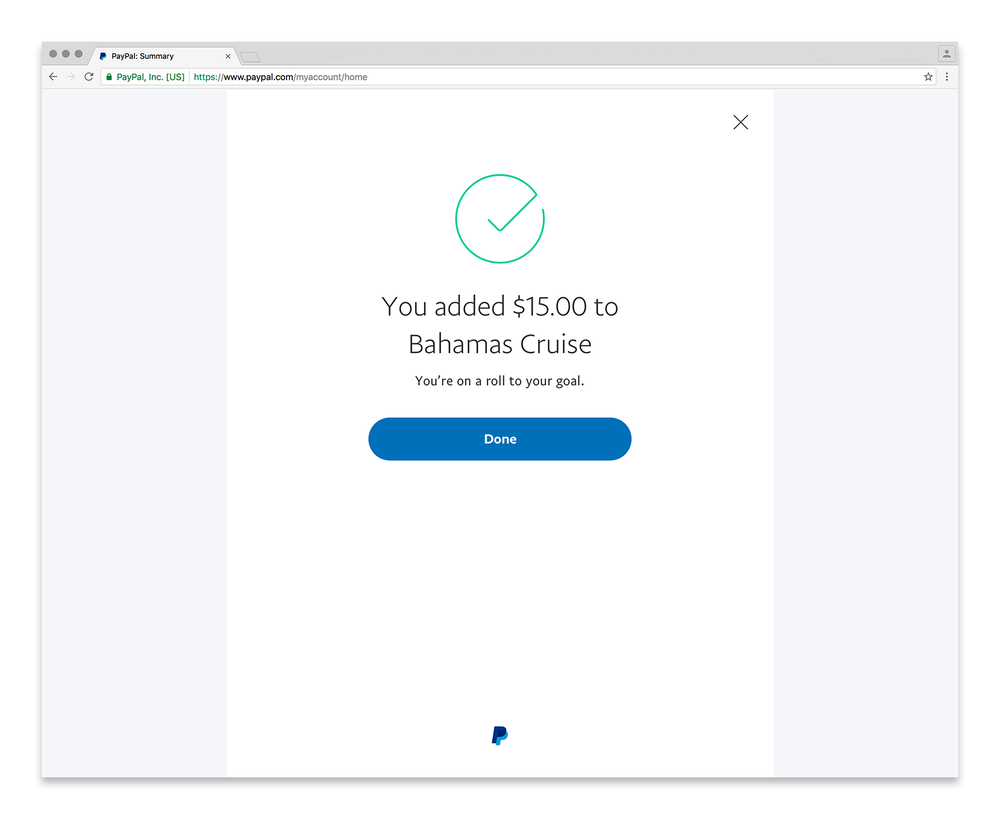

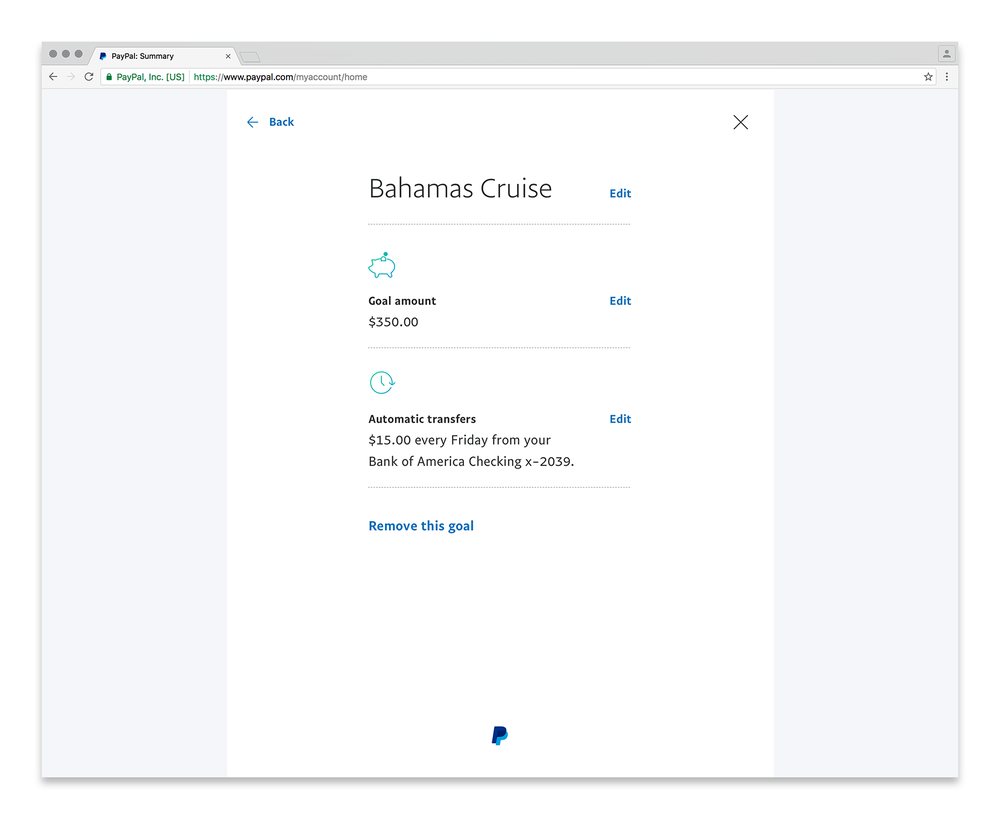

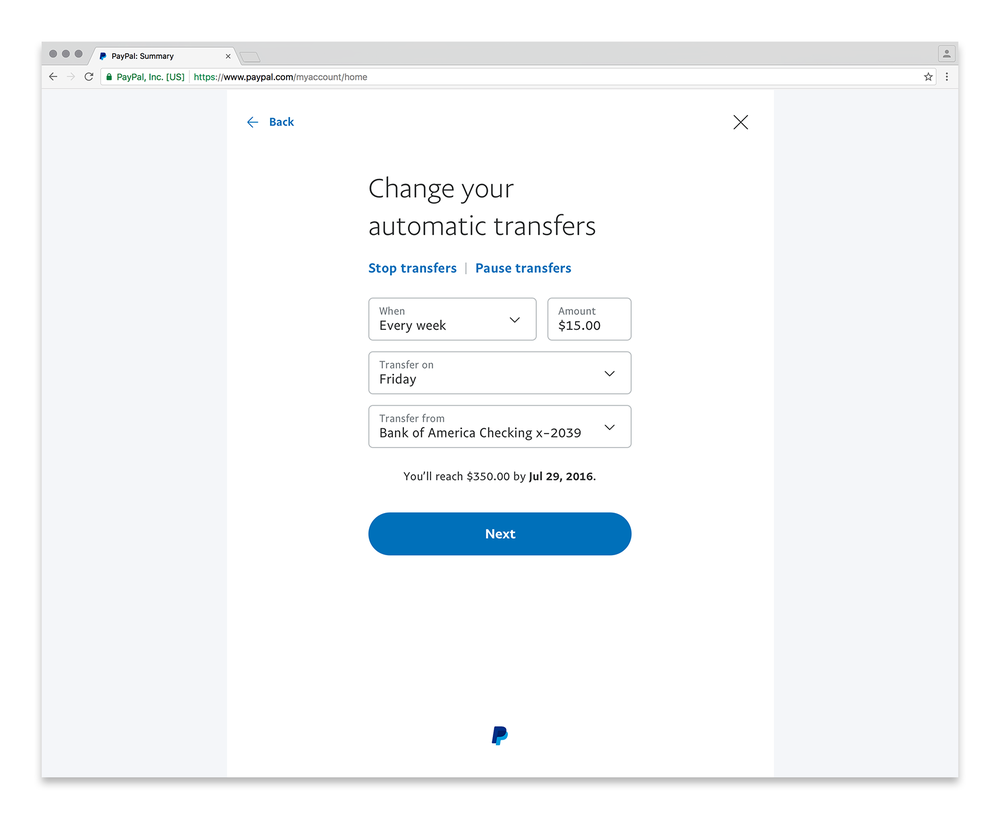

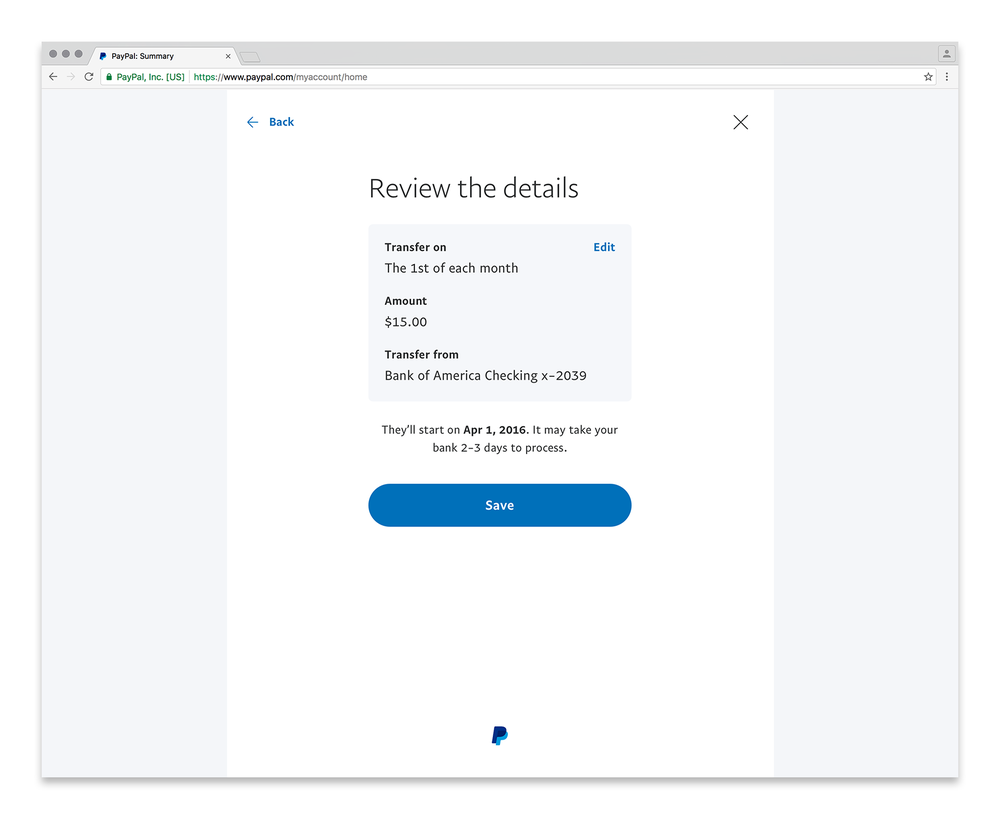

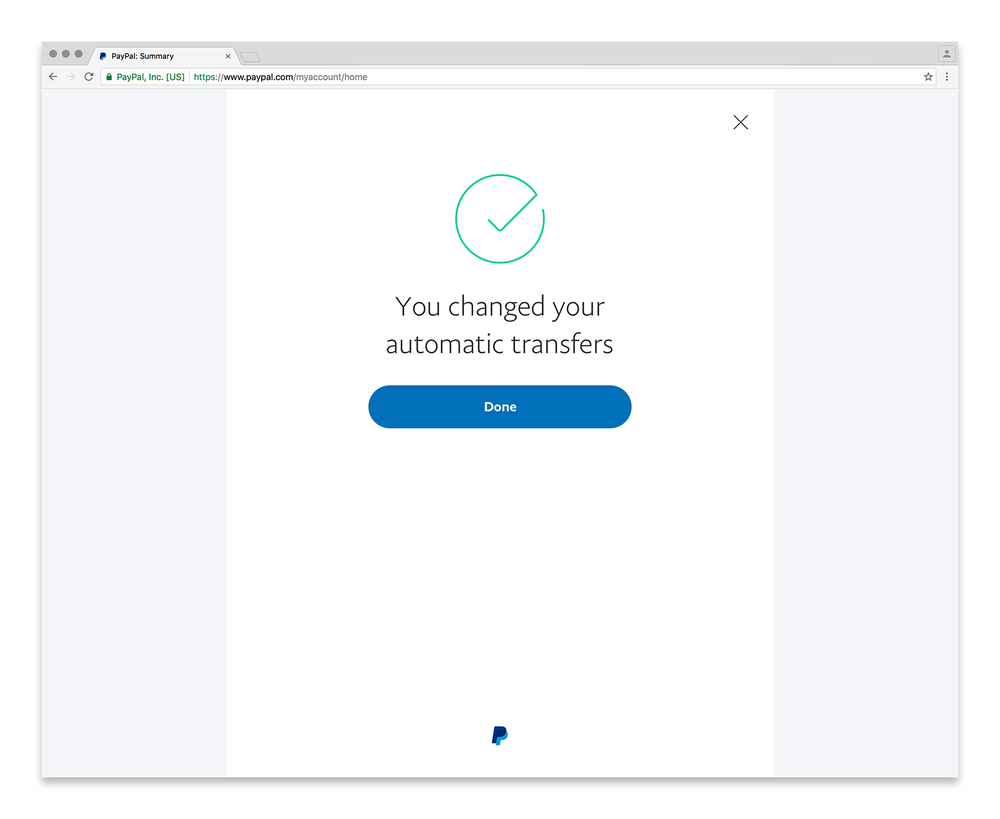

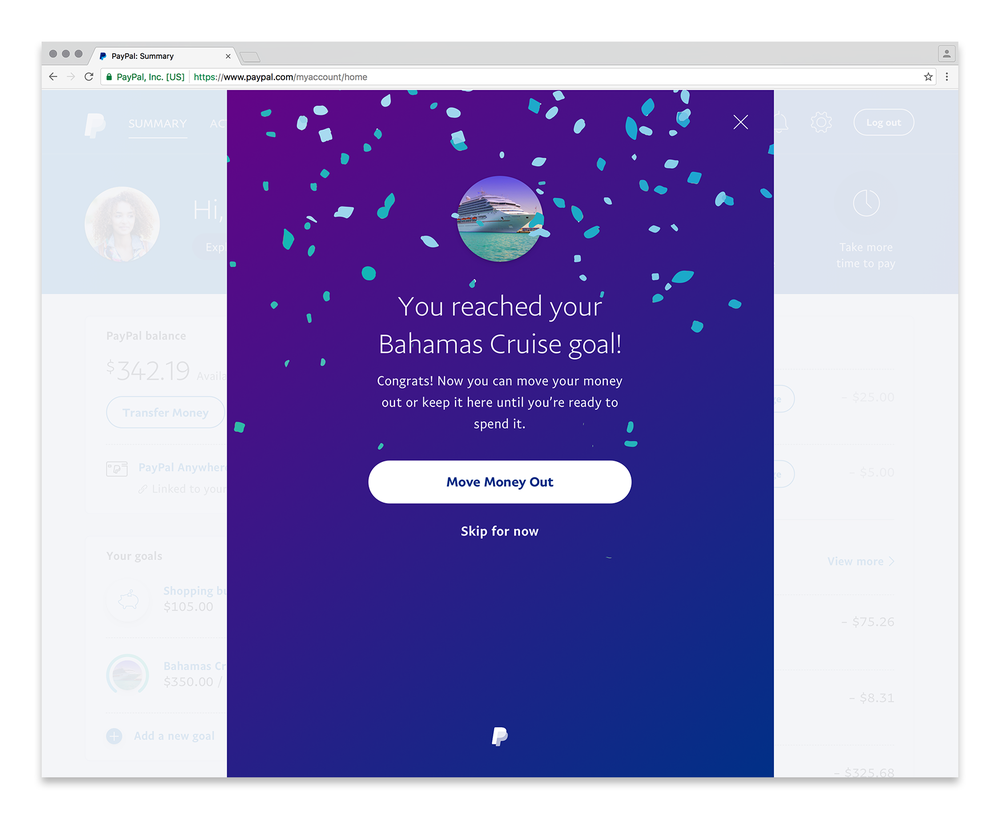

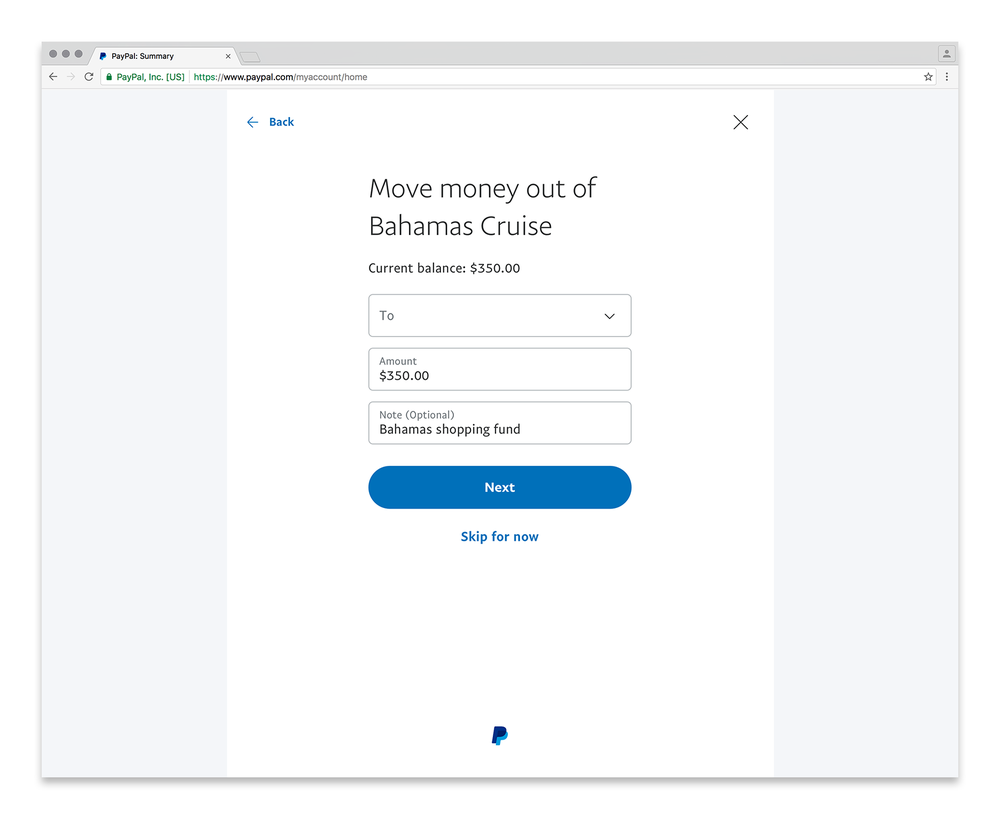

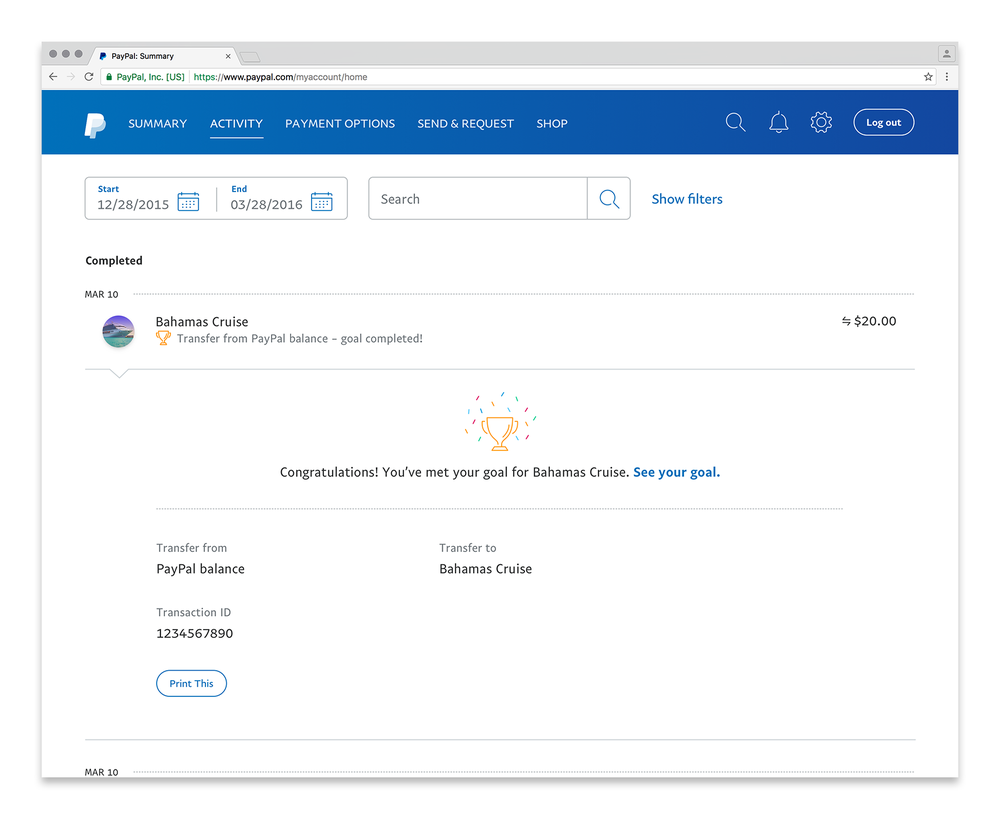

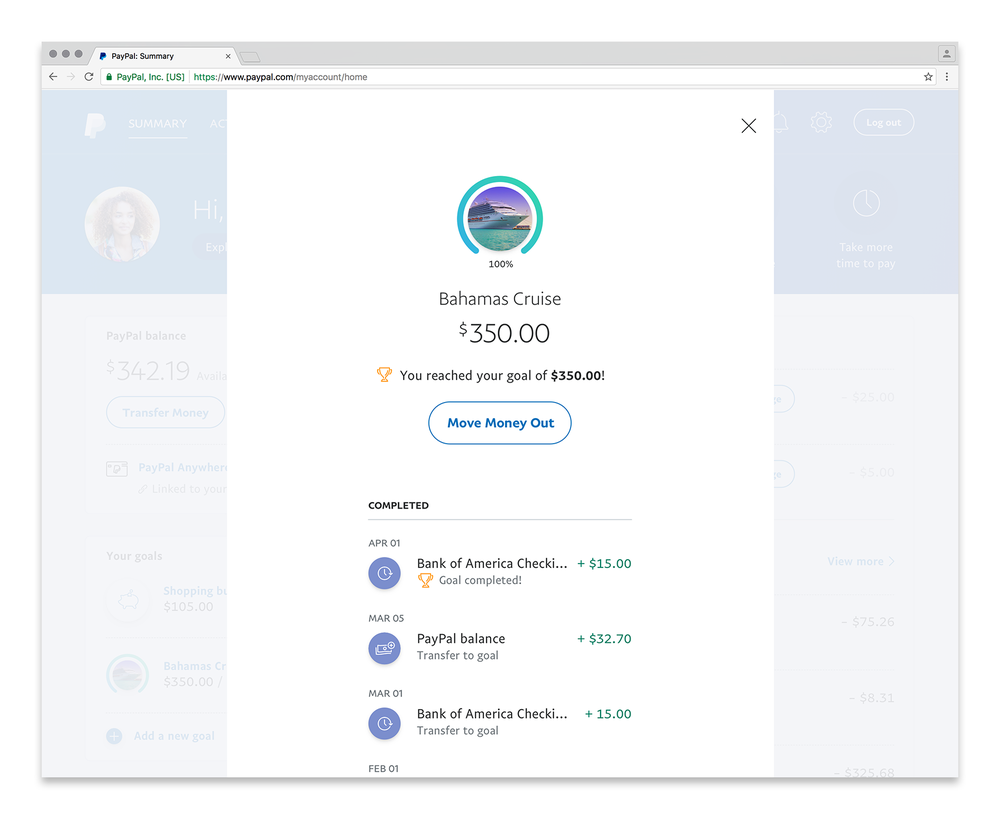

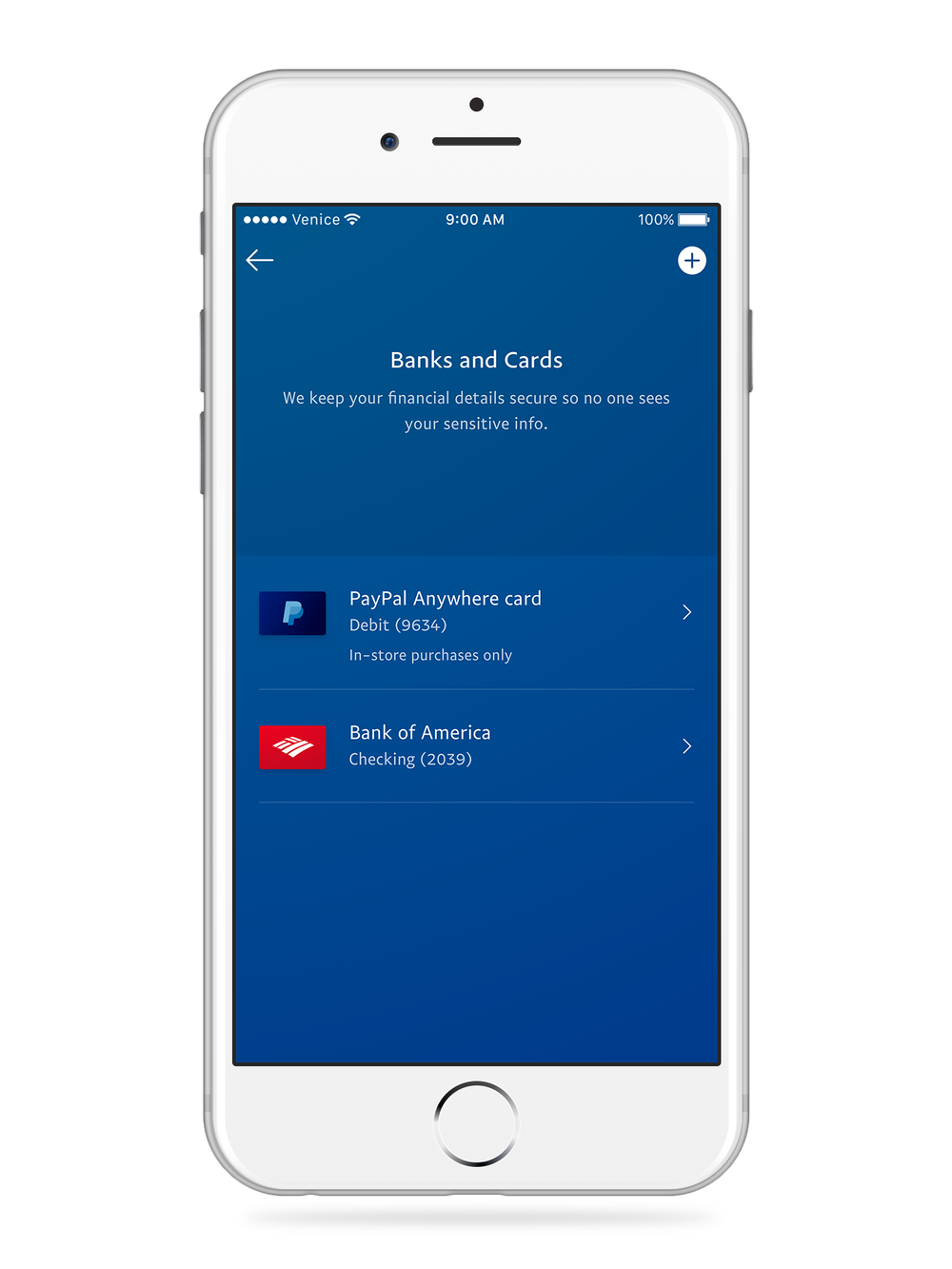

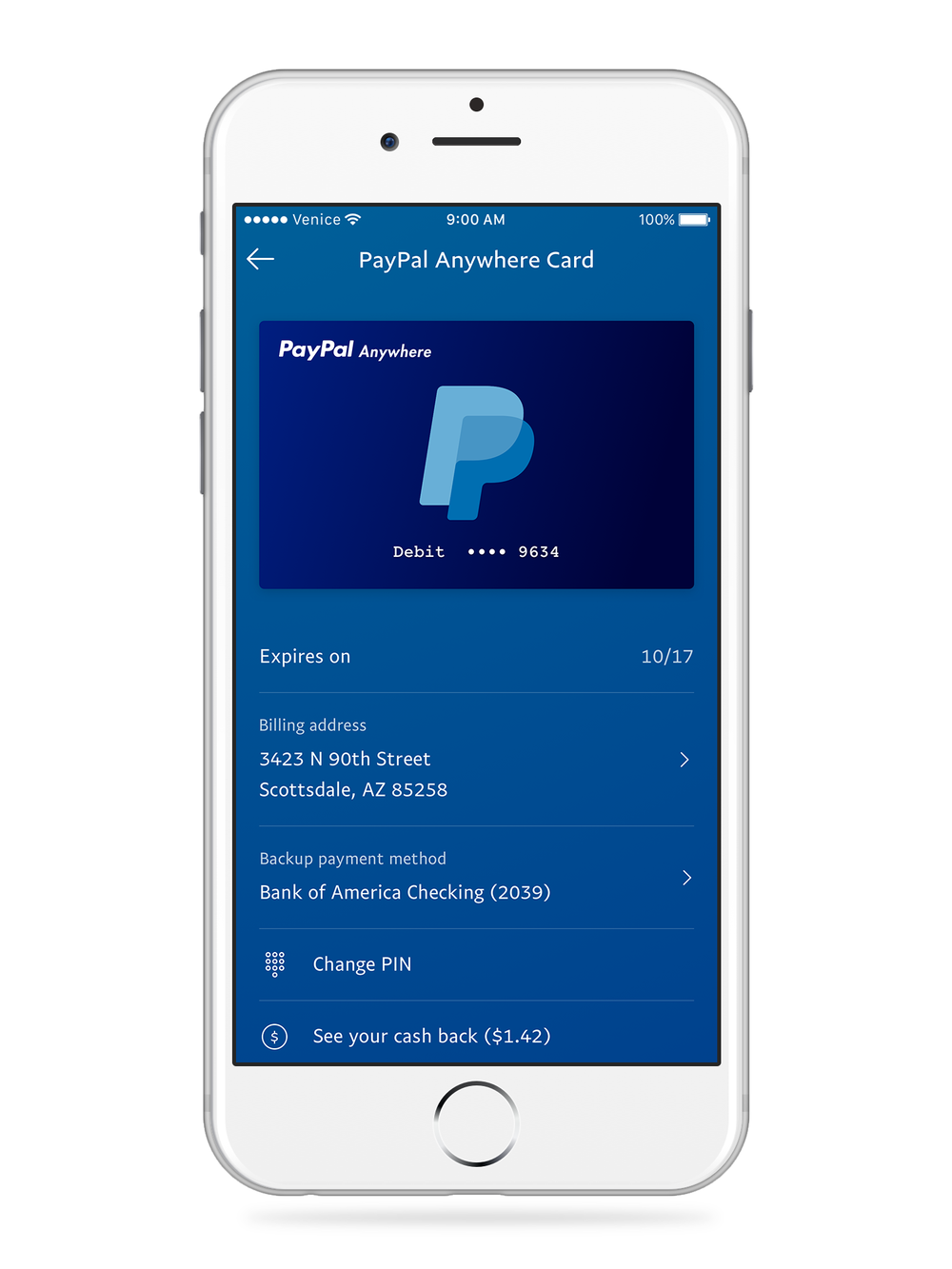

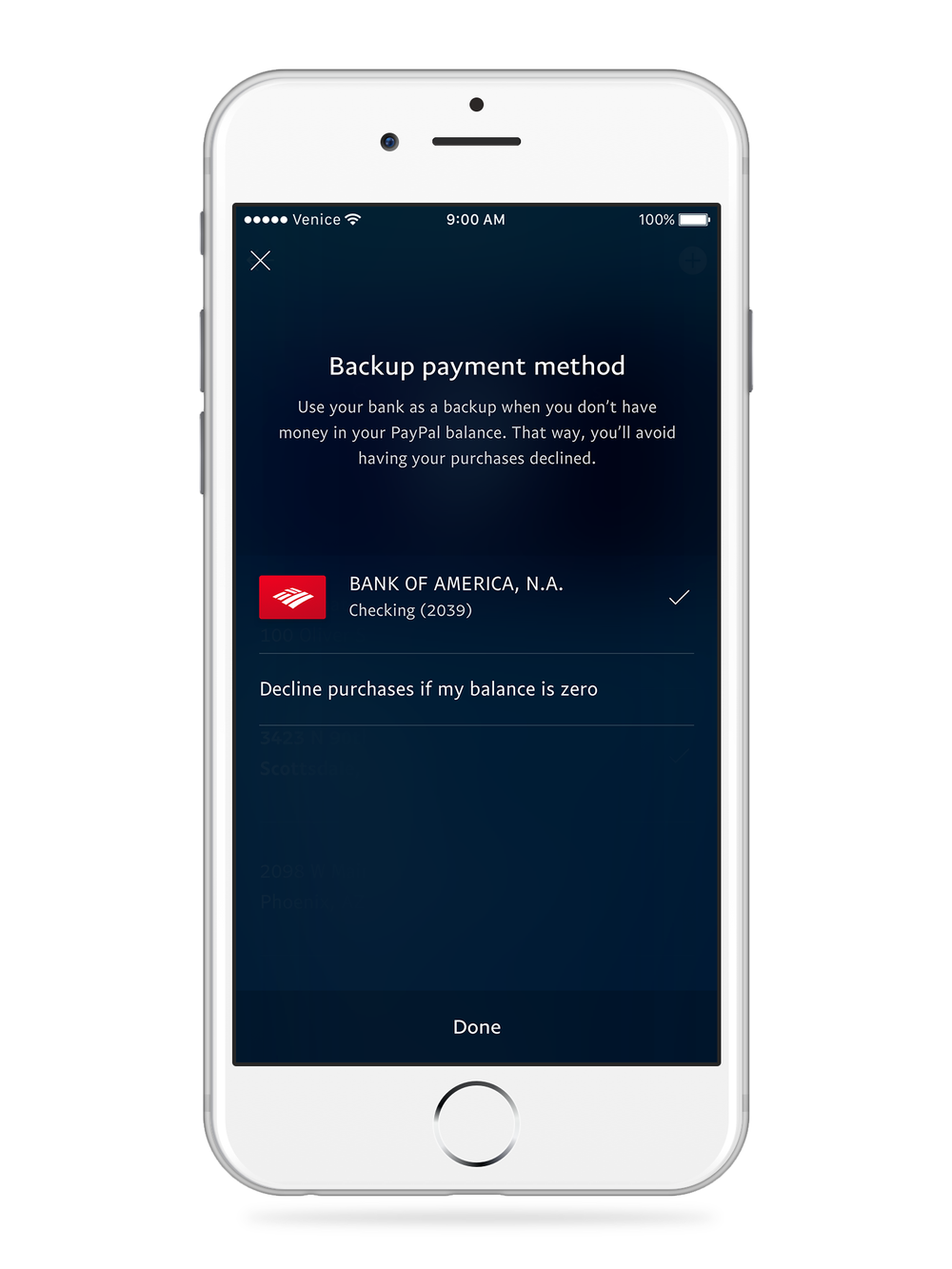

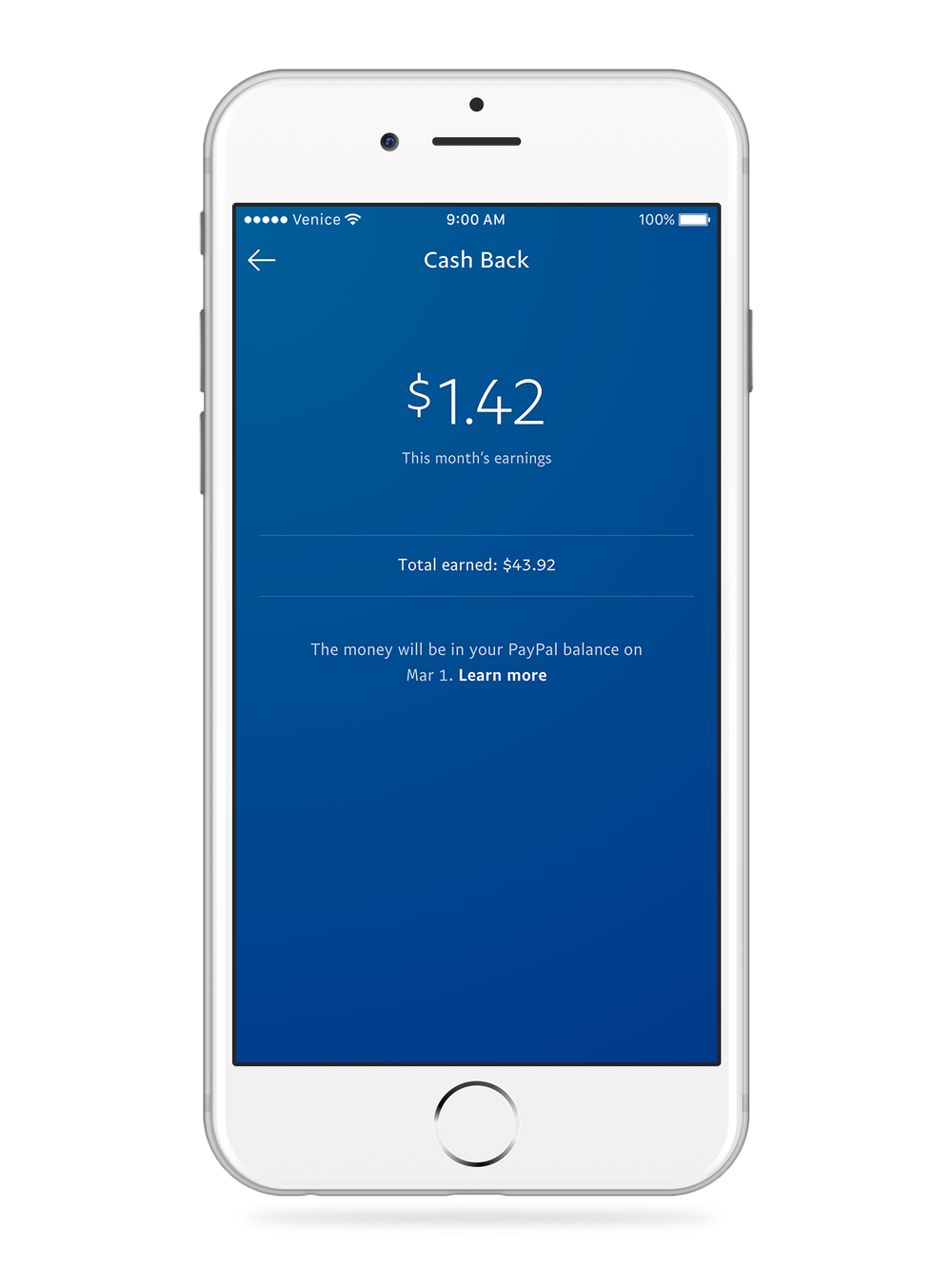

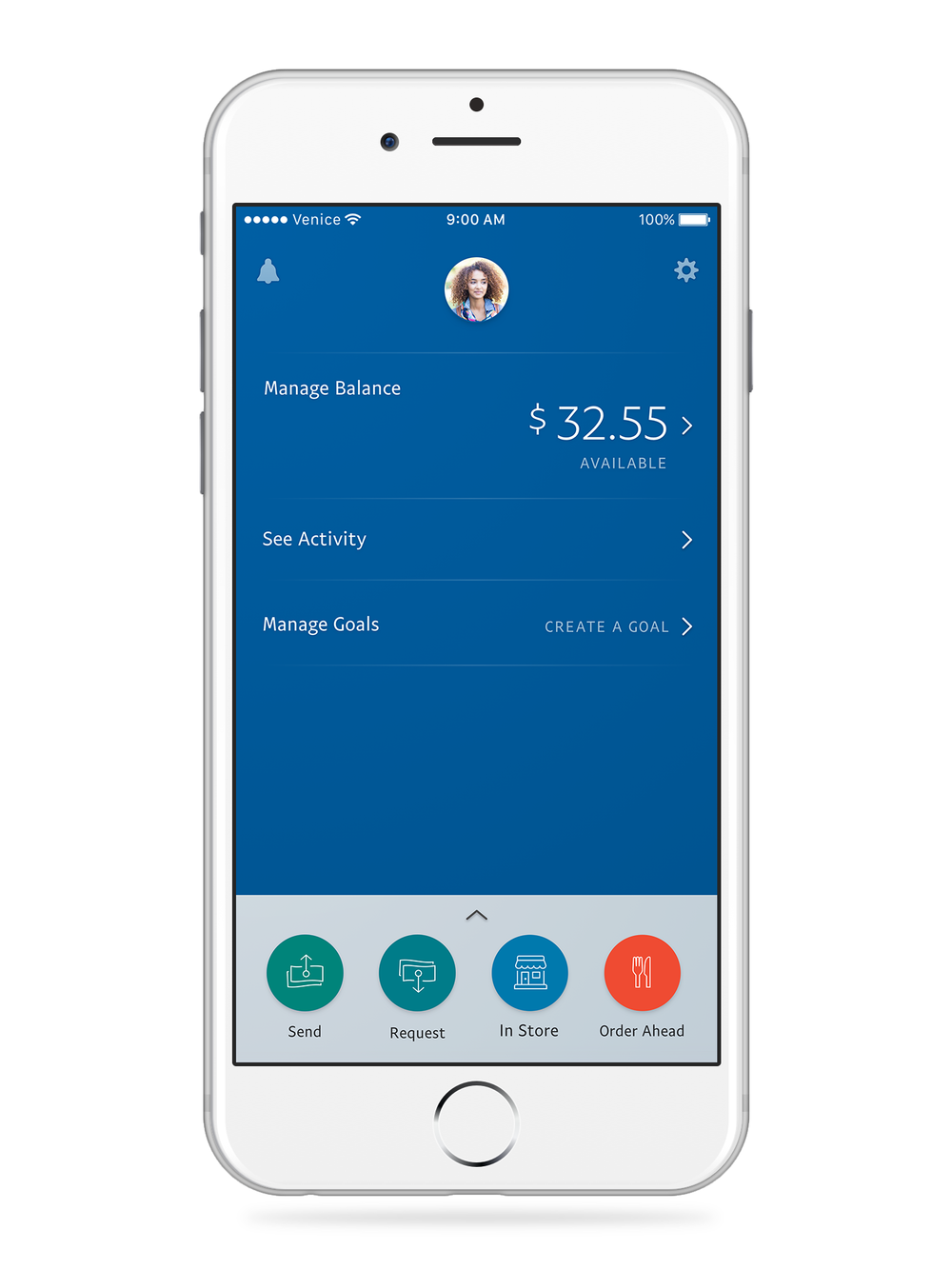

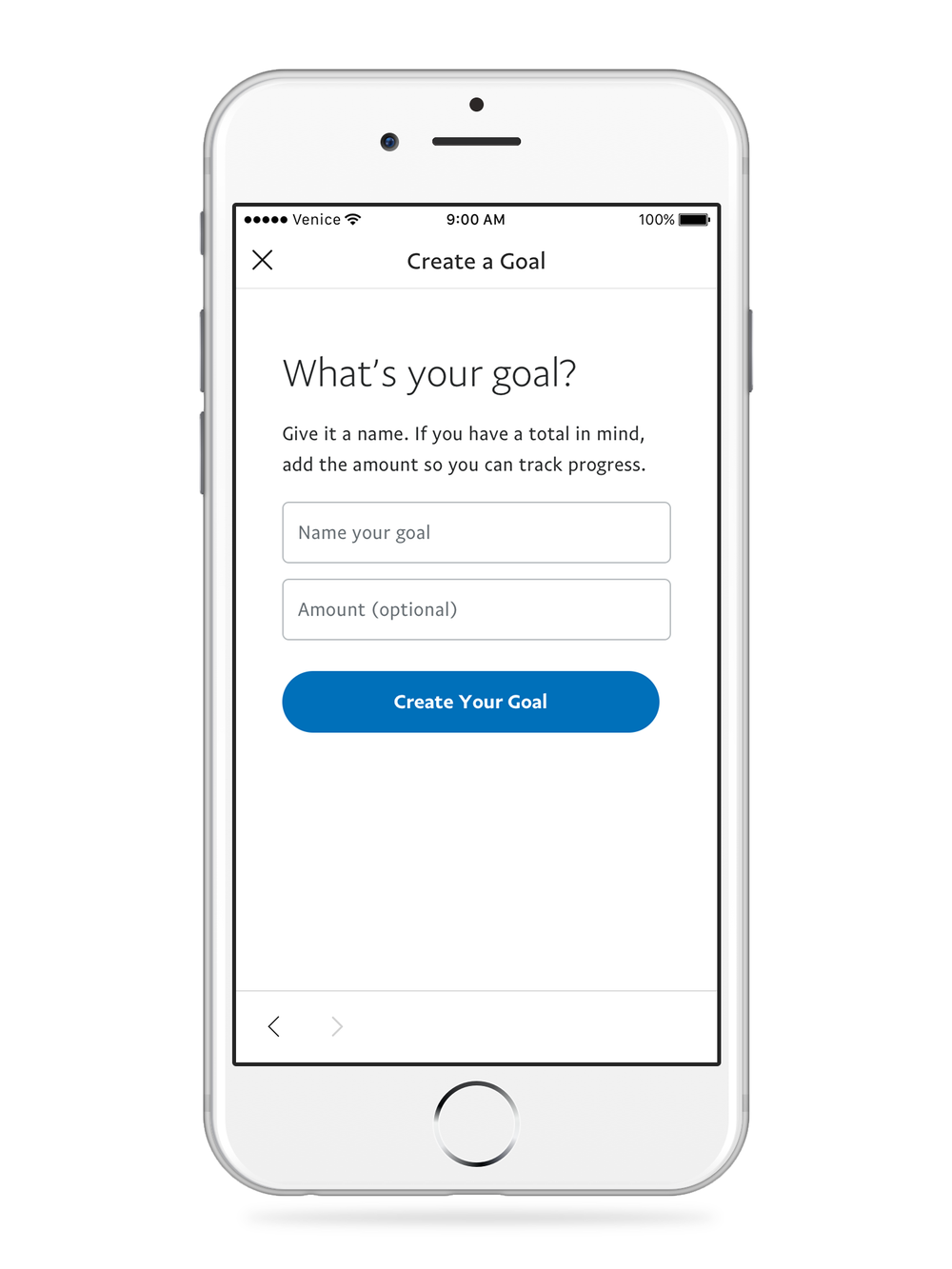

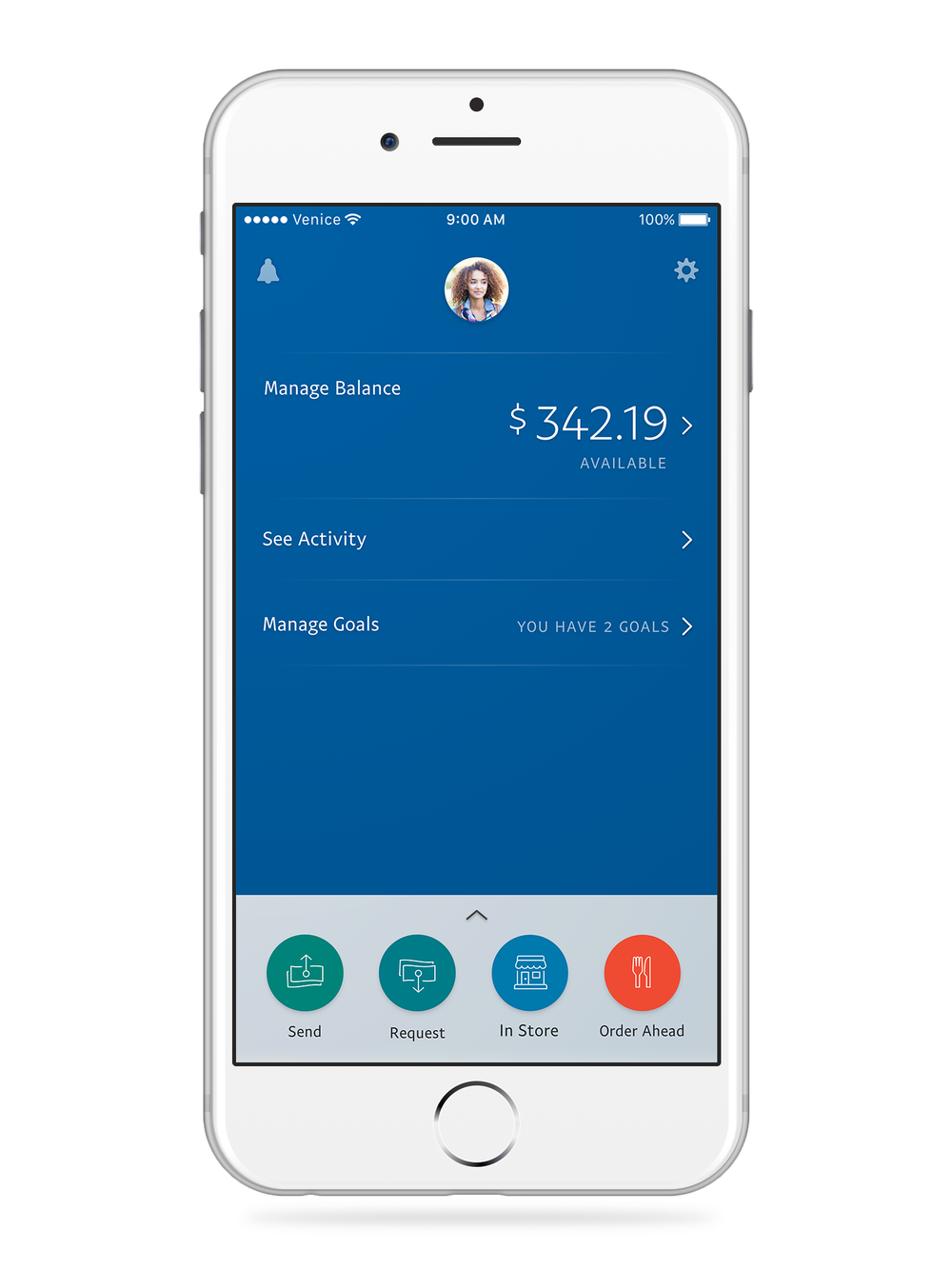

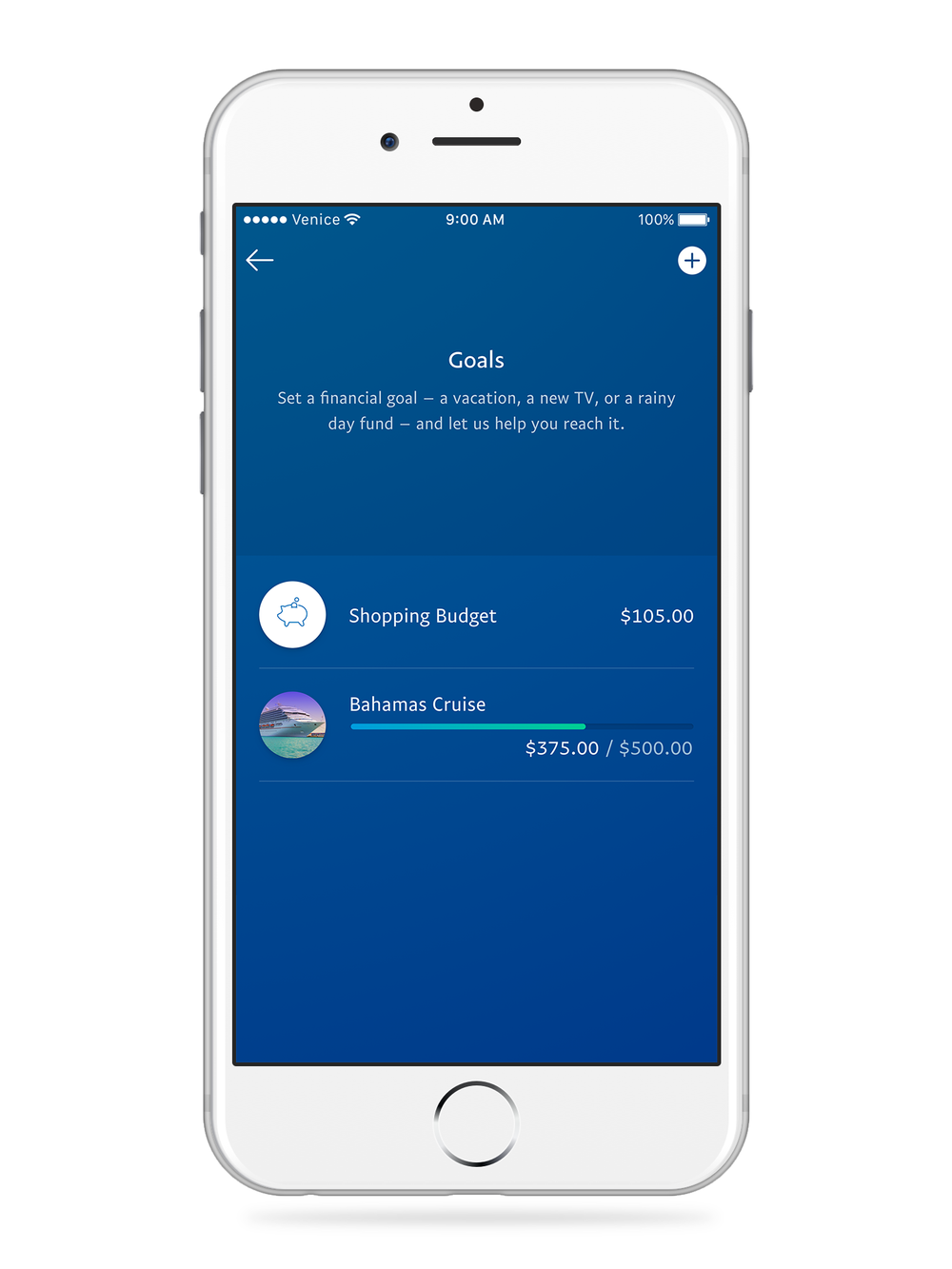

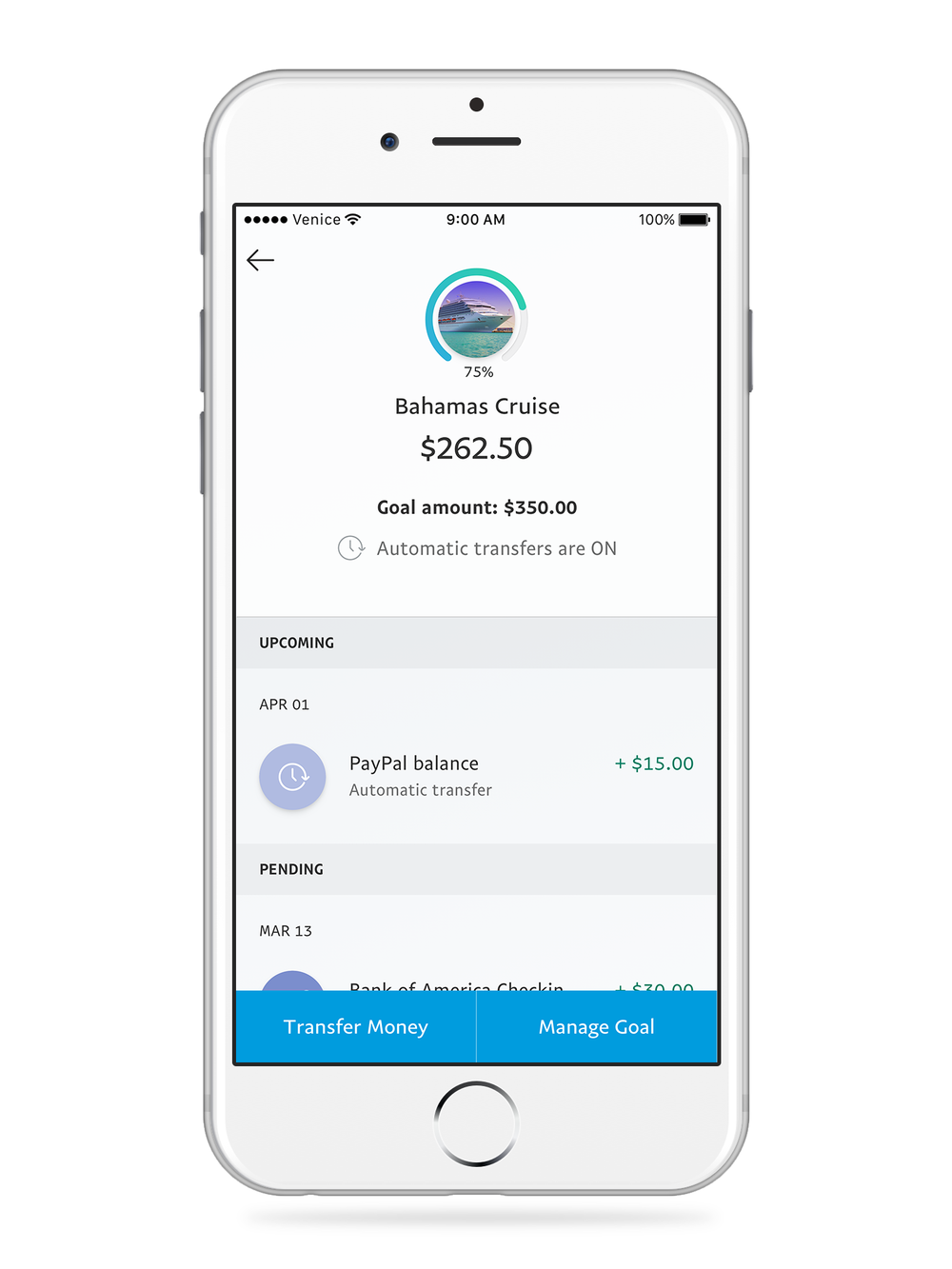

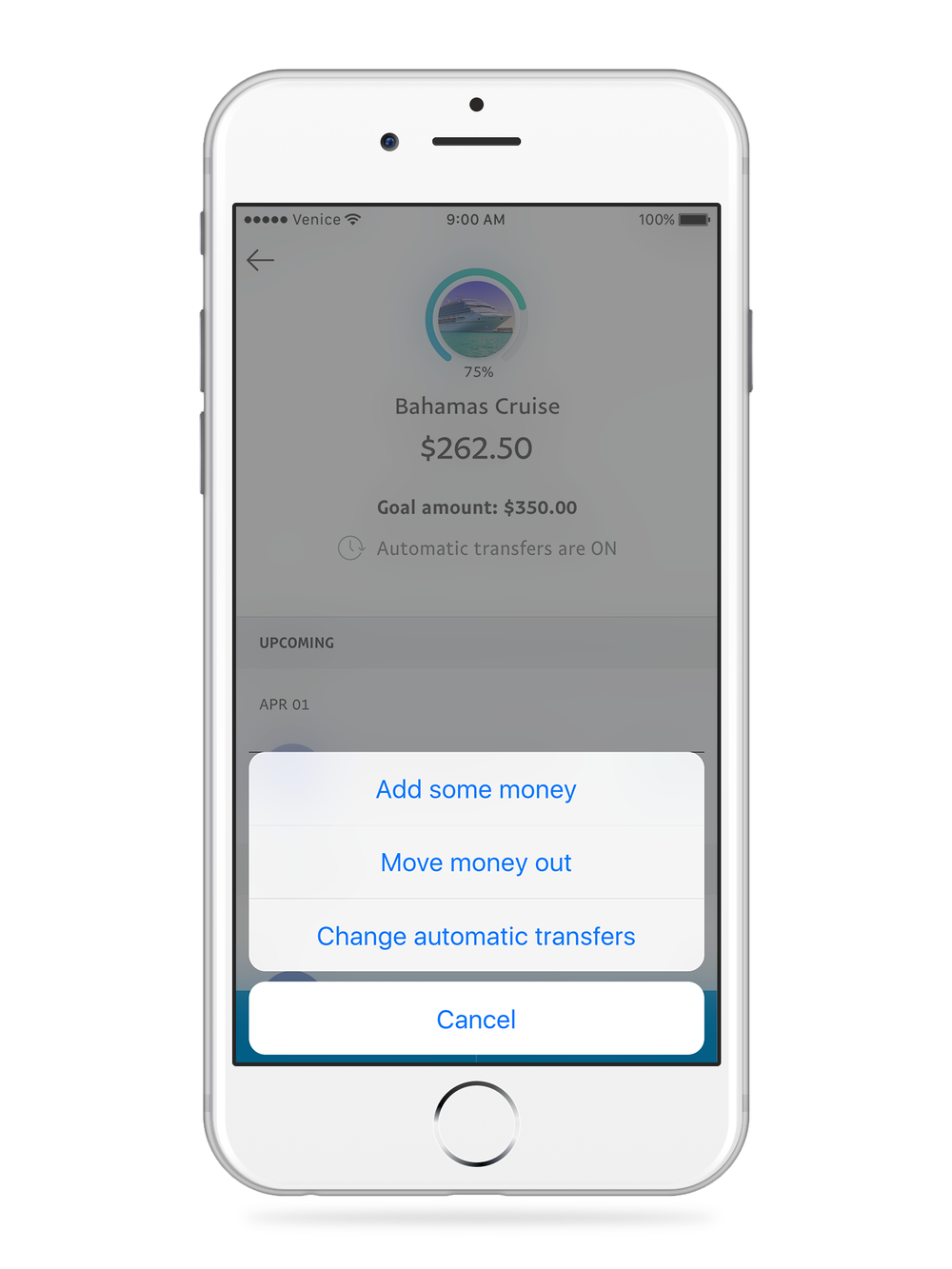

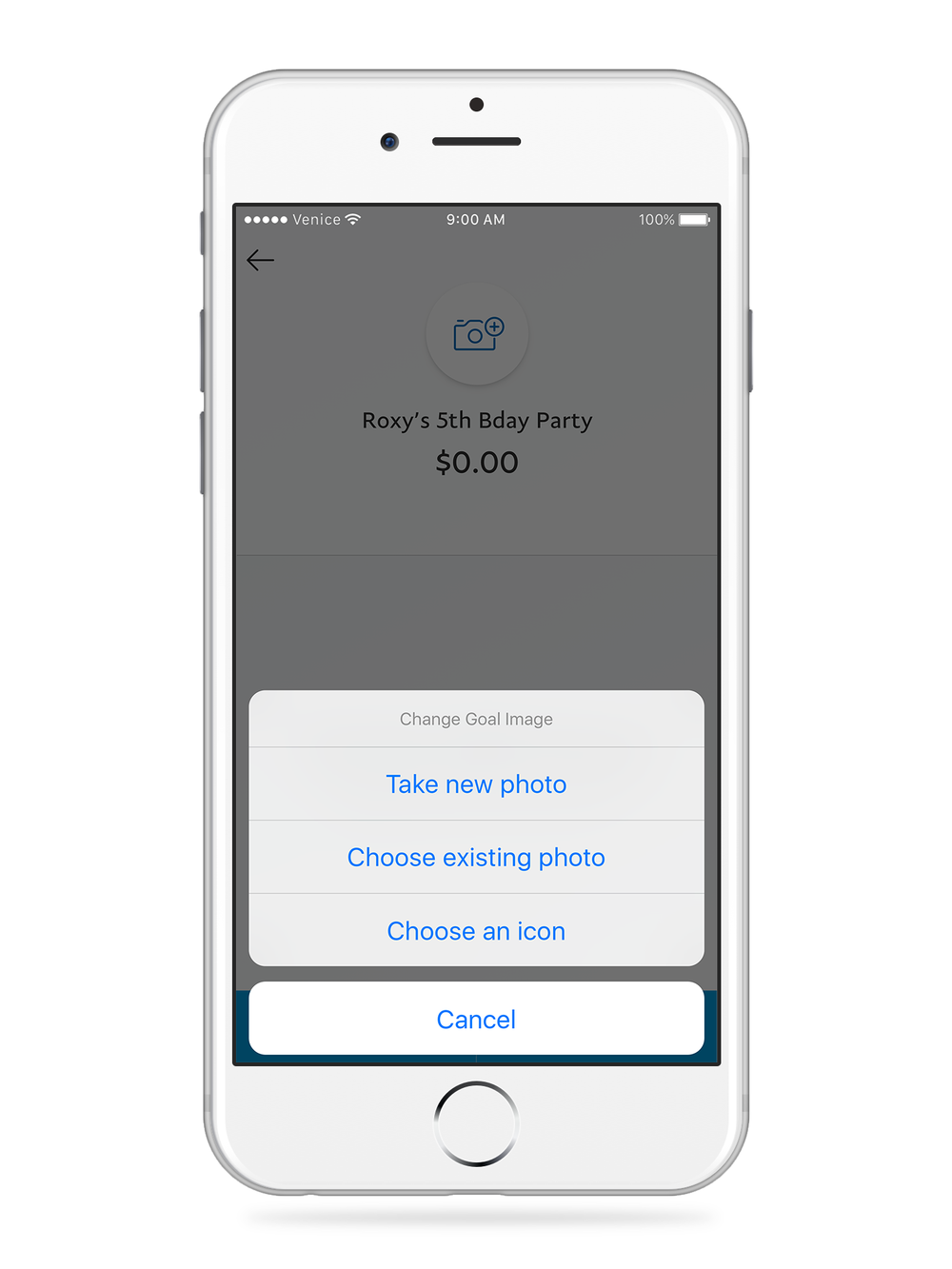

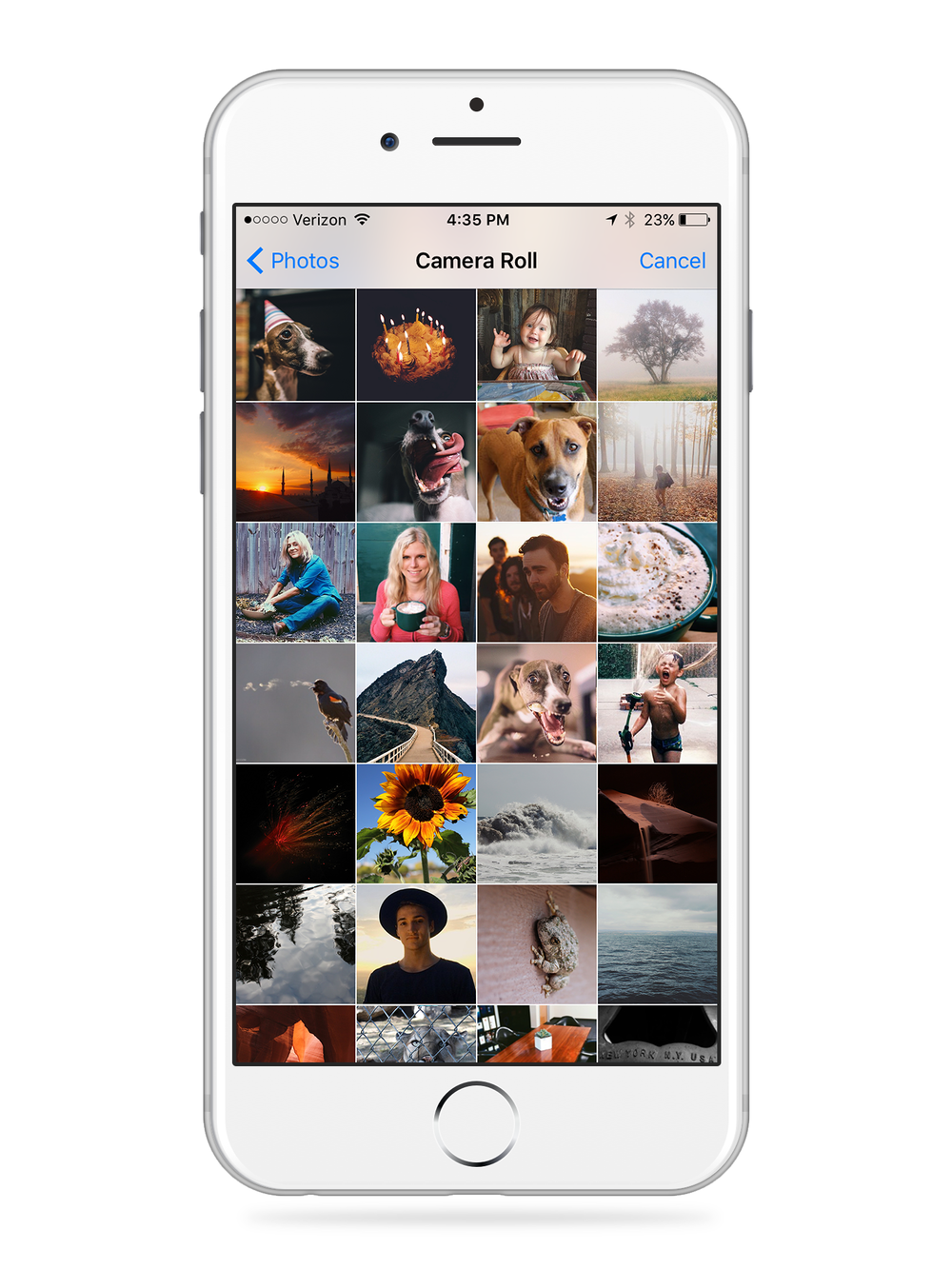

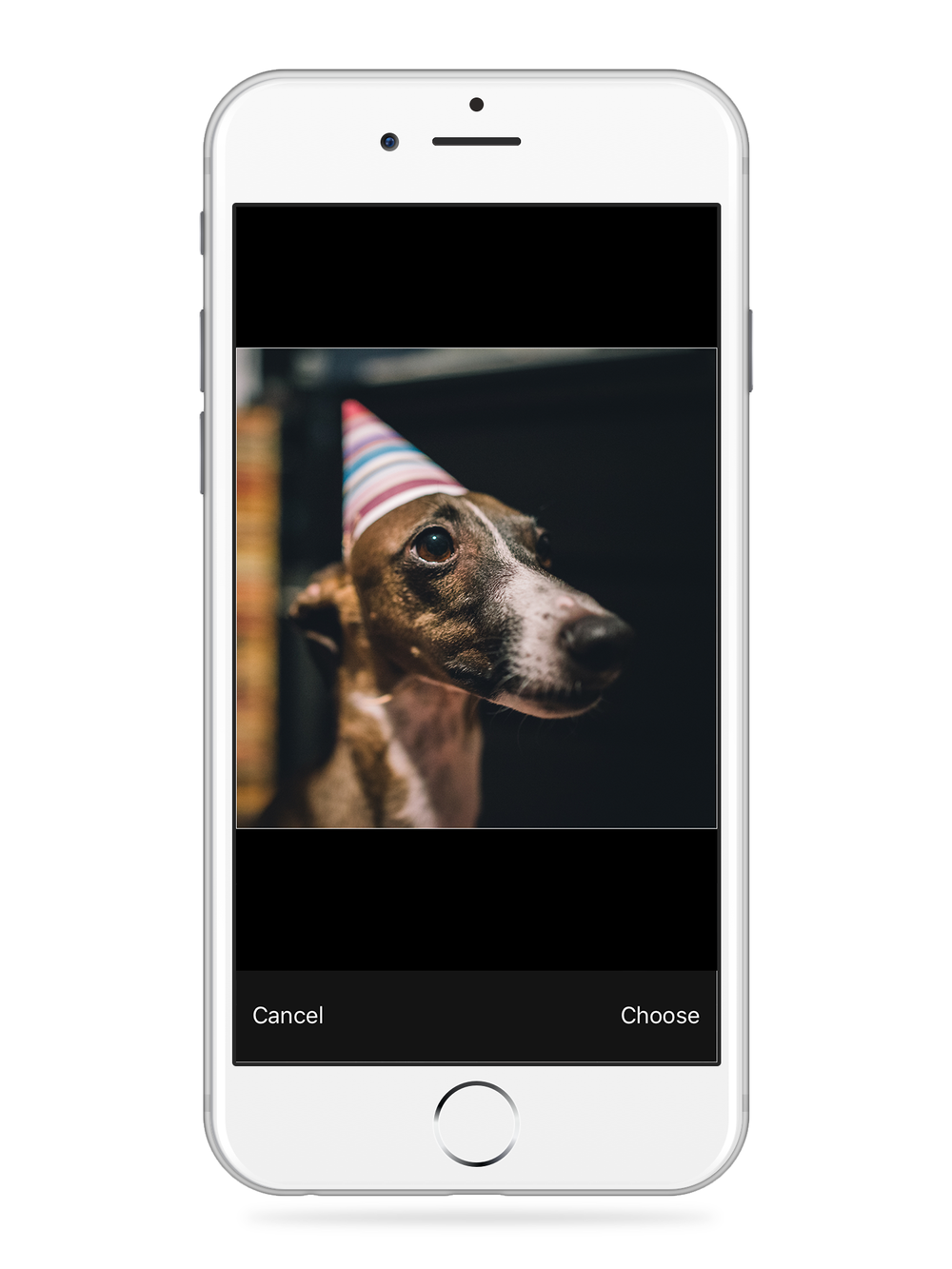

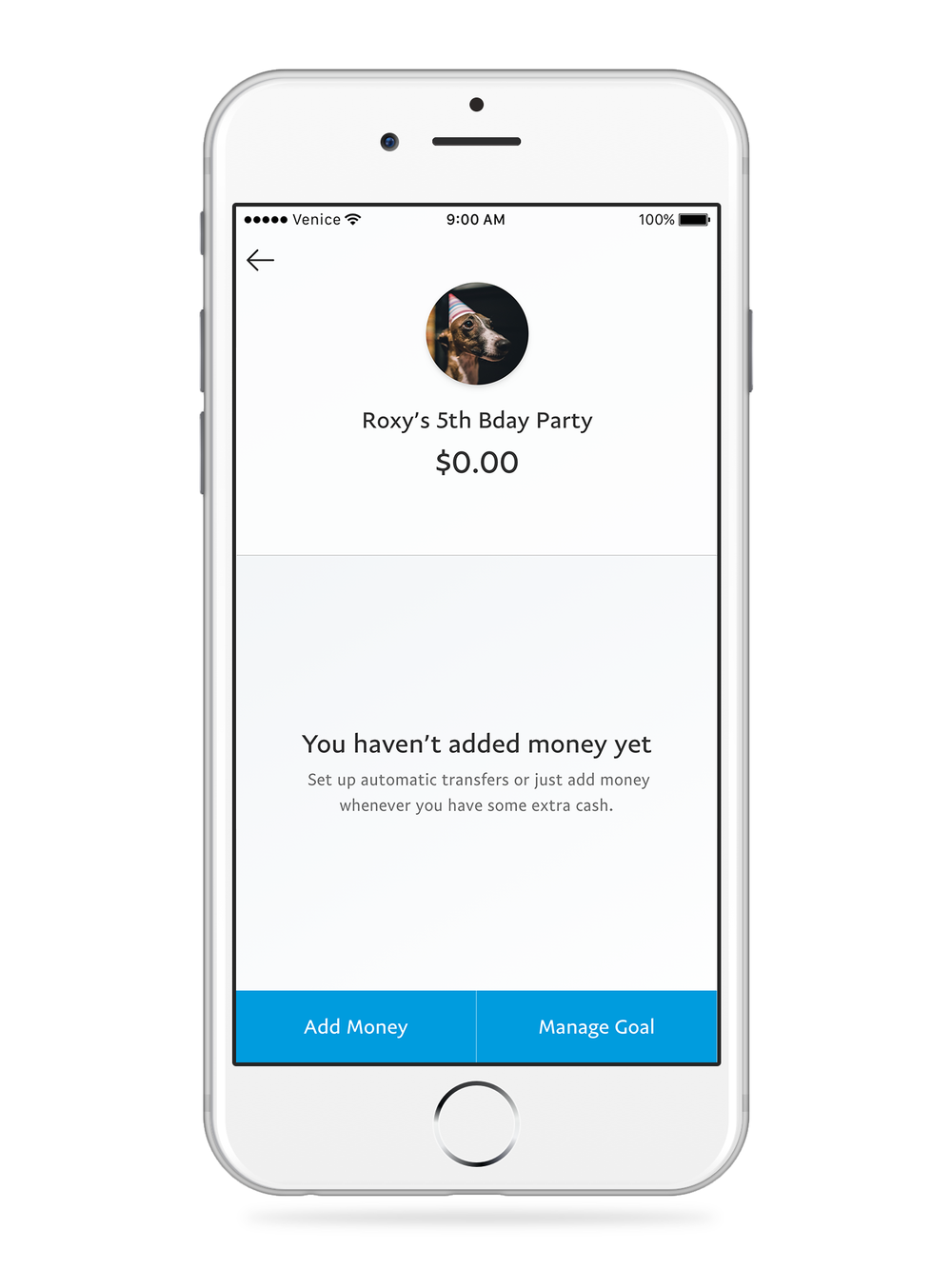

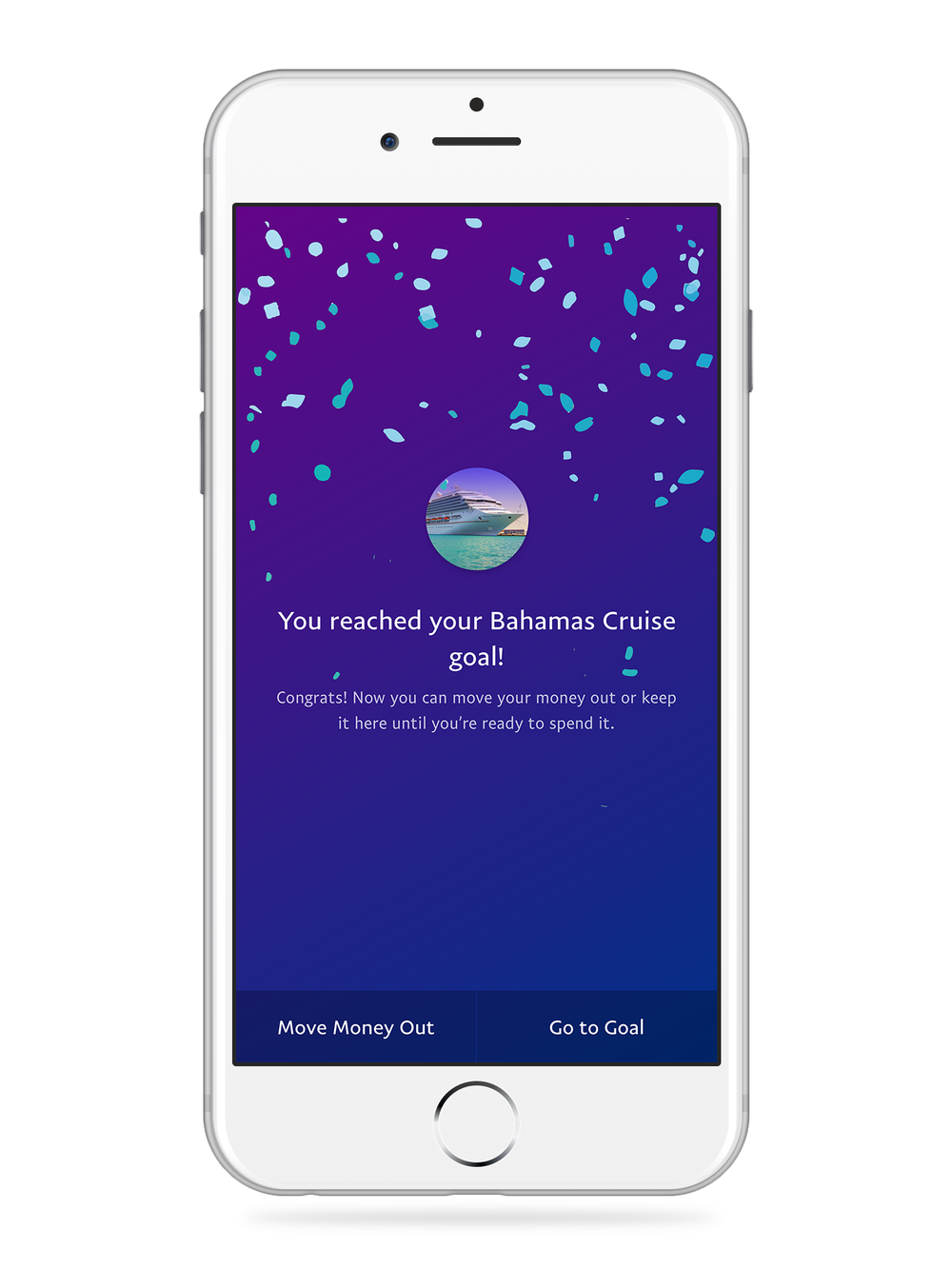

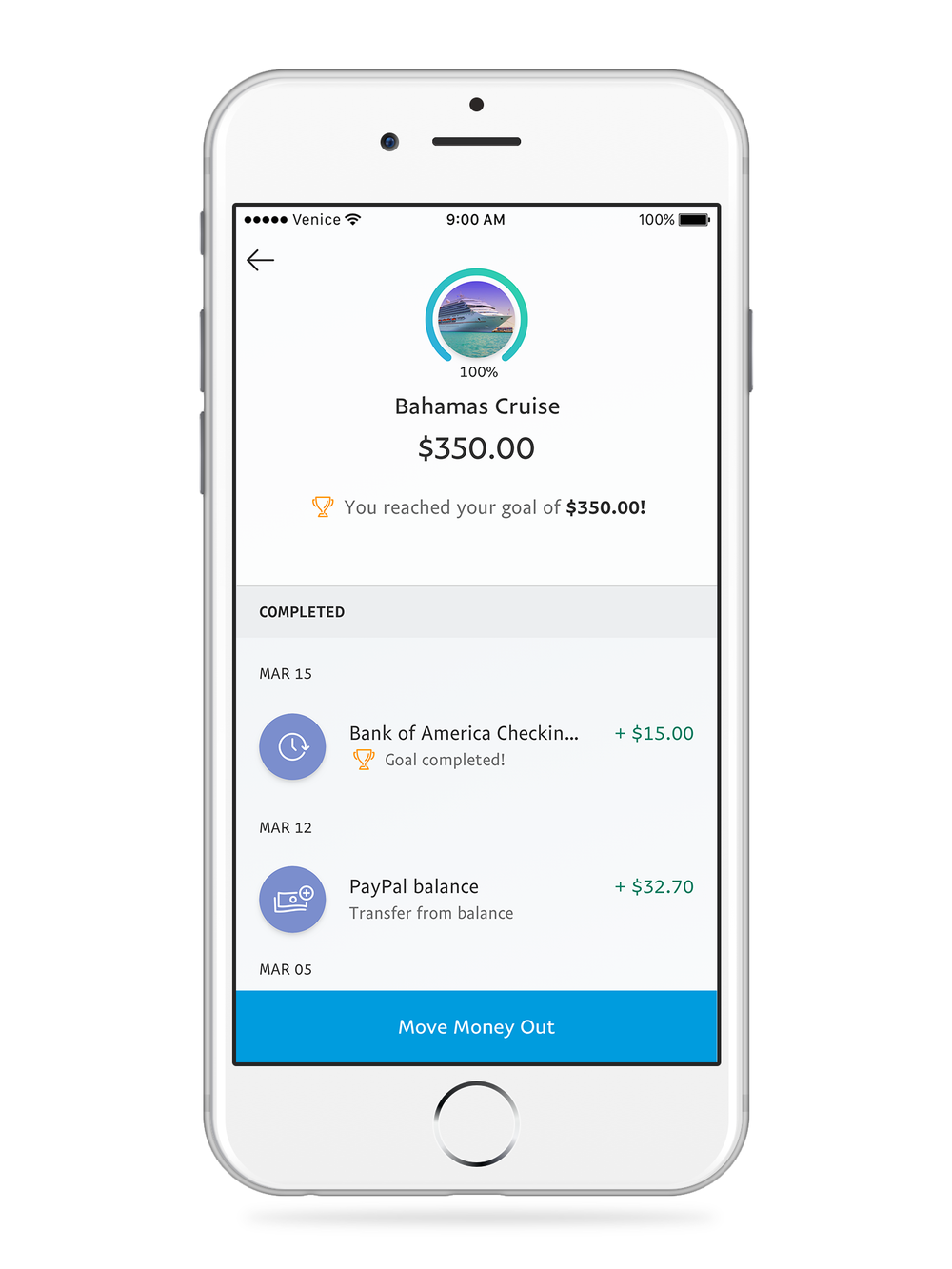

Designed the end-to-end experience for a new PayPal product that provides bank-like features to millions of users who are currently unbanked or underbanked. These new features include direct deposit, FDIC insurance, savings goals and a PayPal debit card with cash back rewards.

Responsibilities included defining the product, architecting its integration with existing PayPal products, and validating the product meets the needs of our target market segment through user testing.

“28 percent of the U.S. population, or about 88 million people, are either unbanked (they have no checking or savings account) or underbanked (they have some relationship with an insured financial institution but still rely on minimally regulated alternative financial service providers such as check-cashing storefronts or payday lenders).”